Note: This section contains information in English only.

Tue, 02 Dec 2014 09:21:15 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"With the effect of the sales tax hike, I don't see real wages rising in the financial year through April."

- Mizuho Securities Co. (based on Bloomberg)

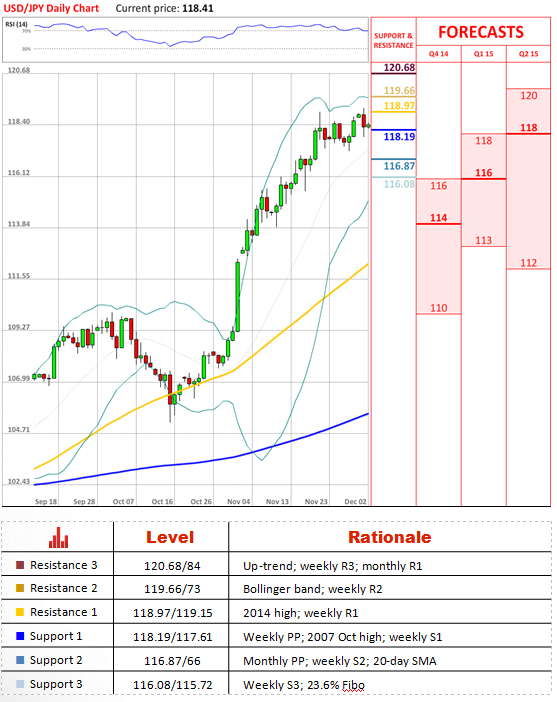

USD/JPY struggled to remain above 118 level yesterday; however, with a help of the weekly PP and 100/200-period SMAs the US Dollar is still trading above the trend-line. Now the pair is climbing towards another major level at 119 and we think that the pair might be ready to surpass it, even though yesterday it failed to do so. The bullish daily PP will be a helpful hand to leave the 119 level behind.

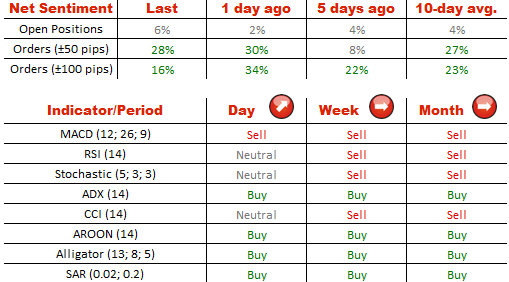

More traders than yesterday consider the dip in USD/JPY to be undervalued; however, the sentiment still remains neutral. Accordingly, the share of long positions grew from 51% up to 53%. The distribution between the buy and sell orders is more stable than yesterday—58% and 42% respectively.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.