- Faros Trading (based on MarketWatch)

Note: This section contains information in English only.

"The inflation was definitely a little bit of a miss and in line with the theory that [the Eurozone] is still struggling with deflationary pressure."

"The inflation was definitely a little bit of a miss and in line with the theory that [the Eurozone] is still struggling with deflationary pressure."

- Faros Trading (based on MarketWatch)

Tue, 01 Apr 2014 06:40:45 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Faros Trading (based on MarketWatch)

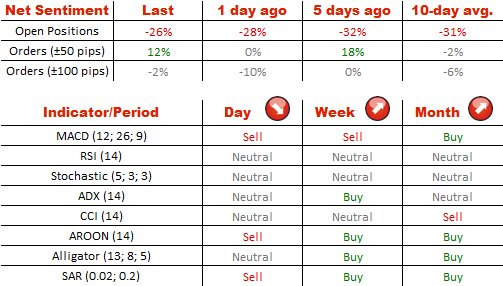

Despite the near-term technical indicators opposing a rally, the Euro is gaining ground after it found support in the face of the 55 and 100-day SMAs. Now the currency pair is challenging the weekly pivot point at 1.3777 and, judging by the weekly and monthly studies, is going to continue advancing further. Thus, the mid-term target is a rising resistance line at 1.3951/25.

Though the bearish views are still popular in the market, the share of short positions is constantly diminishing. Compared to the situation observed five days ago, the percentage of the bears dropped from 66% down to 63%. Meanwhile, there is no significant gap between the numbers of buy and sell orders.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.