Note: This section contains information in English only.

Mon, 31 Mar 2014 15:28:19 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

"The Canadian economy had a bit more energy than expected at the start of the year, managing to rebound nicely from the December ice storm as well as braving the unusual cold in January."

- Bank of Montreal (based on Reuters)

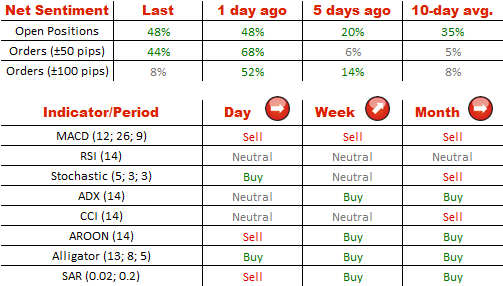

USD/CAD has started this week with a retreat, prolonging last week's decline. The pair is trading just above longer term uptrend's support level at around 1.1014. This trend line has not been broken since it formed on October, therefore, we expect the pair to advance towards 55-day SMA at 1.1087. Majority of weekly and monthly technical indicators are suggesting that the greenback will appreciate against the loonie.

The sentiment among the SWFX traders' has not changed, 74% of them are bullish on this currency pair. In the meantime, the share of orders to enter the market with a sell trade edged up and reached 46%.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.