- BMO Capital Markets (based on MarketWatch)

Note: This section contains information in English only.

"Some of the panic pushing yields higher has subsided and the dollar has ticked a little bit lower alongside that in a very thin market."

"Some of the panic pushing yields higher has subsided and the dollar has ticked a little bit lower alongside that in a very thin market."

- BMO Capital Markets (based on MarketWatch)

Tue, 31 Dec 2013 07:34:52 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- BMO Capital Markets (based on MarketWatch)

USD/CHF remains on the defensive—it has just closed beneath the monthly S2 and therefore may decline even further. The closest significant support is the weekly S1 at 0.8838/18, but it could allow the dip to extend down to the long-term trend-line at 0.8753, which could be drawn through the peaks and valleys charted since June of 2012, meaning it is a potential reversal point.

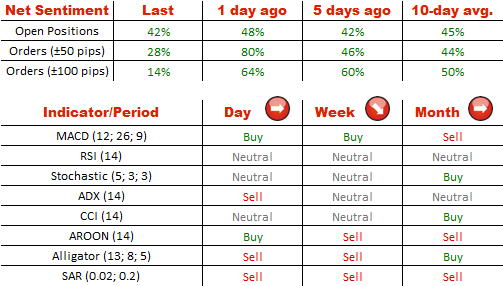

The bullish towards USD/CHF sentiment weakened below the 10-day average—right now 71%, instead of 74% as yesterday, market participants are expecting appreciation of the U.S. Dollar against the Swiss Franc. Speaking of the orders, there are considerably less buy ones—their share plunged from 82% down to 57%.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.