- The Wall Street Journal

Note: This section contains information in English only.

"Now that the Fed has reduced uncertainty in foreign-exchange markets, some investors are betting on a steadily appreciating dollar in 2014."

"Now that the Fed has reduced uncertainty in foreign-exchange markets, some investors are betting on a steadily appreciating dollar in 2014."

- The Wall Street Journal

Fri, 27 Dec 2013 07:56:32 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- The Wall Street Journal

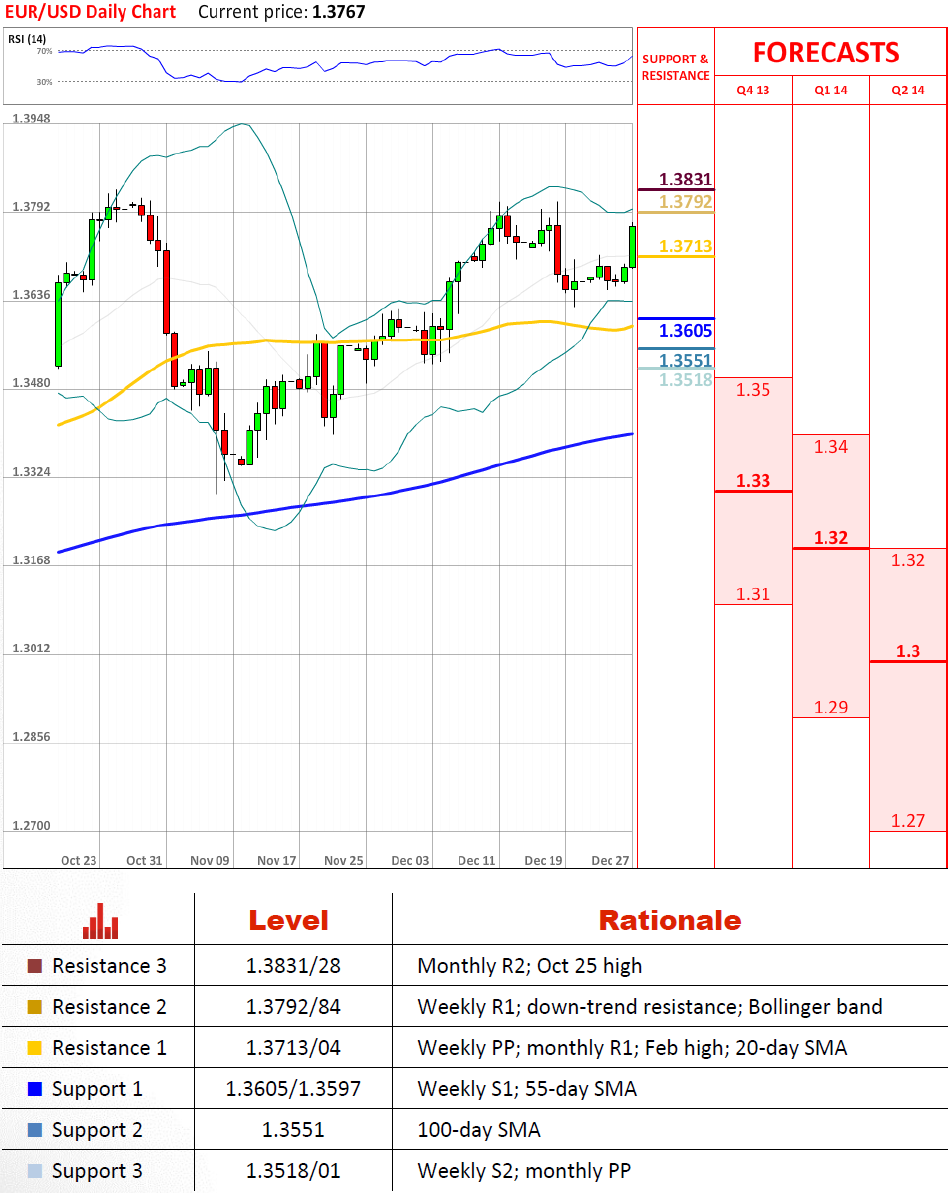

Although EUR/USD was expected to move away from the dense resistance area at 1.3713/04 down to the 55-day SMA, the currency pair is currently trying to erode the nearest resistance. If it succeeds at surpassing this ceiling, the major down-trend line at 1.3792/84 will be exposed, but should rekindle selling despite the ‘buy' signals appearing on the daily and weekly time-frames.

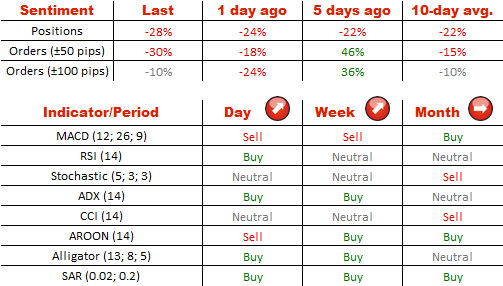

The portion of shorts positions keeps on increasing. Since yesterday their percentage in the market has grown from 62% to 64%. Concerning the orders, while closer to the spot the sell ones enhance their dominance (65%), in a wider range the difference between them and the buy ones decreased to 10 percentage points.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.