- Commonwealth Financial Network (based on Reuters)

Note: This section contains information in English only.

"Signs of the recovery are becoming increasing evident, and the taper could actually be seen as a good thing - a sign of economic normalization - should the Fed pull the trigger this week."

"Signs of the recovery are becoming increasing evident, and the taper could actually be seen as a good thing - a sign of economic normalization - should the Fed pull the trigger this week."

- Commonwealth Financial Network (based on Reuters)

Tue, 17 Dec 2013 07:45:57 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

- Commonwealth Financial Network (based on Reuters)

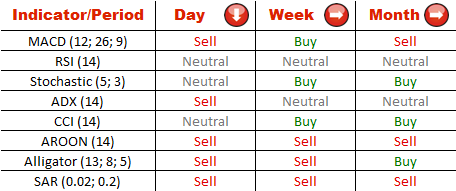

As expected, 0.8892/90 failed to buoy USD/CHF for long and allowed a dip down to the weekly S1 at 0.8850. The next target for the pair should be 0.8798/97, where the weekly S2 merges with the falling support line, although there is a good chance the bearish leg will extend deeper, towards a different down-trend that has been in force since the mid-July.

Even more market participants have decided to take advantage of the greenback's lower price and bet on a soon reversal of the currency pair—the percentage of long positions has grown up to 74%. Meanwhile, the share of buy orders has gone up one percentage point to 69%.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.