Note: This section contains information in English only.

Tue, 16 Jul 2013 07:17:30 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

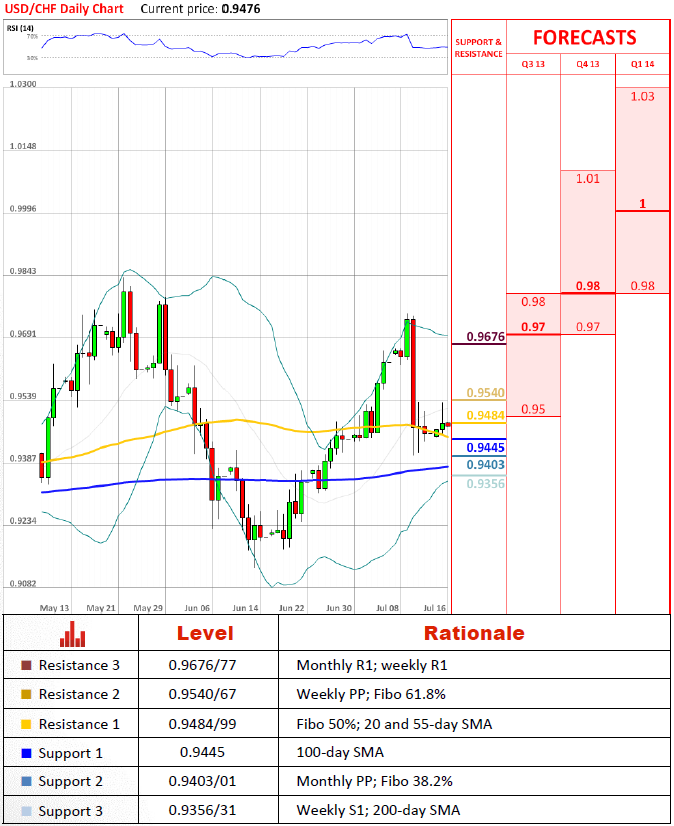

"Price action on forex markets appears largely a function of a consolidating dollar/franc into the end of the week."

- UBS (based on The Economic Times)

For the time being the pair is unable to get back to the pace it had before the sell off last week. At the moment it is struggling to breach 20 and 55-day SMAs. Even if these levels will be breached there remains the question with 0.954 area. Only a close above it would lift most of the downside risk from the pair and give indications that pair could advance above 0.967. Dips should find support with the 100-day SMA.

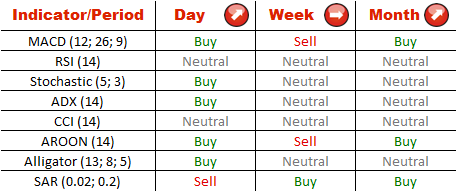

Market sentiment changed insignificantly since yesterday. Share of positions controlled by the bulls increased by 1% and is at 62% gauge. Distribution of pending orders changed by 1% as well, though in favour for the bears and 63% now is set to go short on the pair.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Subscribe

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

Chcete-li se dozvědět více o platformě Dukascopy Bank CFD / Forex, SWFX a dalších souvisejících obchodních informacích, prosím, zavolejte nám, nebo vám můžeme zavolat my.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.