- 54% of all orders are to sell the Sterling

- 51% of traders still hold long positions

- Immediate resistance is at 1.2907

- The closest support rests at 1.2886

-

Upcoming events: US Empire State Manufacturing Index, UK Prime Minister May's Speech, UK CPI, UK PPI Output, UK RPI, UK HPI, US Building Permits, US Housing Starts, US Capacity Utilization Rate, US Industrial Production

Consumer prices in the United States advanced last month but less than analysts expected. The Labour Department reported on Friday that its CPI rose 0.2% in April, following the preceding month's drop of 0.3% but missing expectations for a 0.3% gain. Furthermore, the so-called core inflation rate climbed 0.1% last month, compared to the previous month's fall of 0.1%, whereas analysts anticipated an increase of 0.2%. However, both figures pointed to a tightening labour market and solid inflation growth, suggesting that the Federal Reserve will likely raise interest rates at its June meeting. April's inflation rebound was mainly attributable to the oil price rebound. Other data released by the Commerce Department showed retail sales rose 0.4% in April, following the prior month's upwardly revised gain of 0.1% and falling behind forecasts for a 0.6% increase.

Meanwhile, core retail sales, which exclude volatile items, climbed 0.3%, unchanged from the preceding month's upwardly revised reading, while analysts anticipated a 0.5% climb. According to the Atlanta Fed, the economy is set to expand 3.6% in the Q2 of 2017.

Watch More: Dukascopy TV

Relatively quiet Monday

There are no important events on Monday really, with the only relevant data release being the US Empire State Manufacturing Index, which gauges business conditions for New York manufacturers. However, UK's May is scheduled to speak today; and any information provided concerning the Brexit deal is likely to strengthen the Sterling further, unless unpleasant information is delivered. On Tuesday, traders could focus on the UK inflation data and the US housing market figures, such as the Building Permits and Housing Starts.

Read More: Fundamental Analysis

GBP/USD on route to erasing last week's losses

Even though the US inflation data disappointed on Friday, the Cable was still unable to close in the green zone, but did manage to negate all intraday losses. Trade remained relatively unchanged, with the consolidation trend also intact, thus, a positive development today is expected. The 1.30 mark is the trend's upper border, which is unlikely to be reached today, as no strong market movers are expected to emerge today. However, the nearest resistance, namely the weekly PP, is not much of an obstacle; therefore, more attention should be paid to the second supply area, formed by the weekly R1 and the upper Bollinger band circa 1.2985.

Daily chart

The ascending channel risked getting pierced to the downside on Friday, but the exchange rate gave another shot at recovering today. As a result, the 200-hour SMA was pierced, opening the door towards reaching the channel's upper boundary, which could be easily put to the test by the end of the week.Hourly chart

Read More: Technical Analysis

Traders remain neutral

Market sentiment remains bullish, but now with bulls slightly outnumbering the bears, as 51% of all open positions are long. Meanwhile, 54% of all pending orders are to sell the British Pound.

A less optimistic situation is observed elsewhere. The sentiment at OANDA remains bearish, namely 64% of all open positions are short and the remaining 36% are long. Meanwhile, sentiment at Saxo Bank worsened again, with 62% of traders now being short and the other 38% - long on the Sterling against the US Dollar.

Spreads (avg, pip) / Trading volume / Volatility

Traders still indecisive

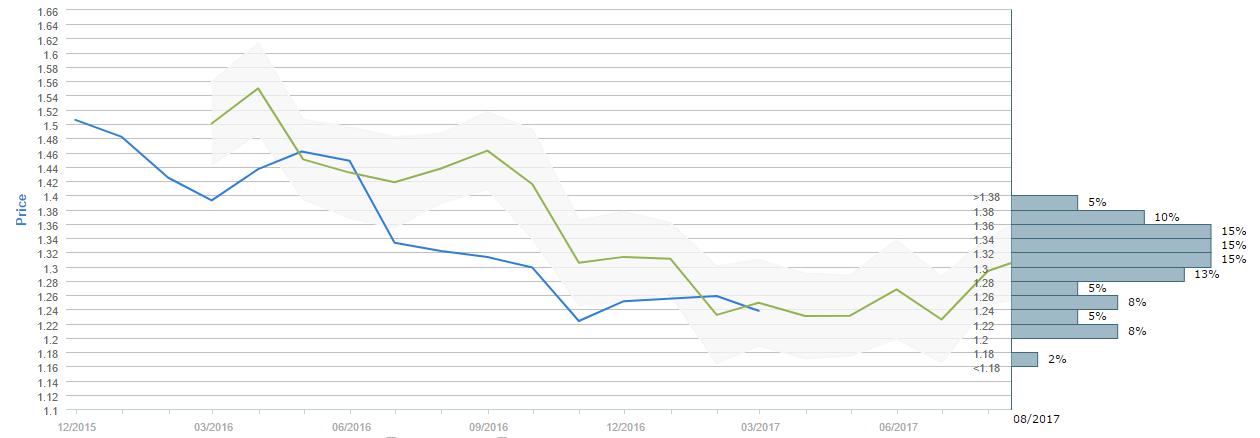

© Dukascopy Bank SABy the end of the next three months traders believe the Cable is to rise above the 1.30 major level, as 60% of survey participants believe so. While the current price is around 1.29, the average forecast for August 15 is 1.3032. The 1.30-1.32, the 1.32-1.34 and the 1.34-1.36 ranges are now the most popular price intervals, having 15% of the votes each, while second comes the 1.28-1.30 interval with 13% of the voters, and the third place is tied by the 1.20-1.22 and the 1.36-1.38, with 10% of poll participants choosing either of these options.

Note: This section contains information in English only.

Mon, 15 May 2017 10:56:42 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Abonnieren

Um mehr über die Forex/CFD Handelsplattform von Dukascopy Bank SA, sowie über den SWFX und weitere handelsbezogene Informationen zu erfahren,

rufen Sie uns bitte an oder hinterlassen Sie eine Rückrufanfrage.

rufen Sie uns bitte an oder hinterlassen Sie eine Rückrufanfrage.

Für weitere Informationen über eine mögliche Zusammenarbeit,

bitte rufen Sie uns an oder fordern Sie einen Rückruf an.

bitte rufen Sie uns an oder fordern Sie einen Rückruf an.

Um mehr über die Dukascopy Bank Binären Optionen zu lernen

/Forex Handelsplattform, SWFX und andere Handelsbezogenen Informationen,

bitte rufen Sie uns an oder fordern Sie einen Rückruf an.

bitte rufen Sie uns an oder fordern Sie einen Rückruf an.

Um mehr über die Forex/CFD Handelsplattform von Dukascopy Bank SA, sowie über den SWFX und weitere Handelsbezogenen Informationen zu erfahren,

rufen Sie uns bitte an oder hinterlassen Sie eine Rückrufanfrage.

rufen Sie uns bitte an oder hinterlassen Sie eine Rückrufanfrage.

Um mehr über Krypto Handel/CFD/ Forex Handelsplattform, SWFX und andere Handelsbezogenen Informationen zu erfahren,

bitte rufen Sie uns an oder fordern Sie einen Rückruf an.

bitte rufen Sie uns an oder fordern Sie einen Rückruf an.

Um mehr über Business Introducer und andere Handelsbezogenen Informationen zu erfahren,

bitte rufen Sie uns an oder fordern Sie einen Rückruf an.

bitte rufen Sie uns an oder fordern Sie einen Rückruf an.

Für weitere Informationen über eine mögliche Zusammenarbeit,

rufen Sie uns bitte an oder bitten Sie um einen Rückruf.

rufen Sie uns bitte an oder bitten Sie um einen Rückruf.