Scegli tra 8 diverse categorie di asset per un totale di più di 1500 strumenti di trading

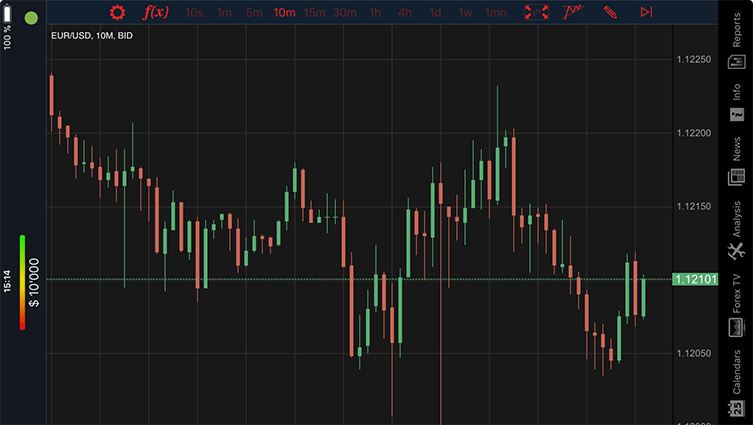

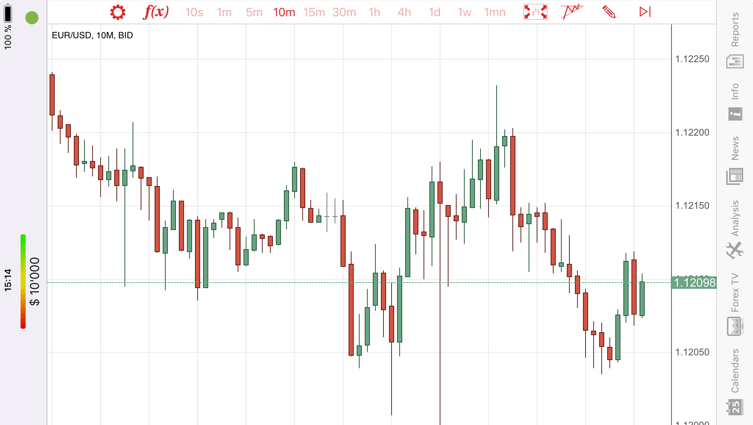

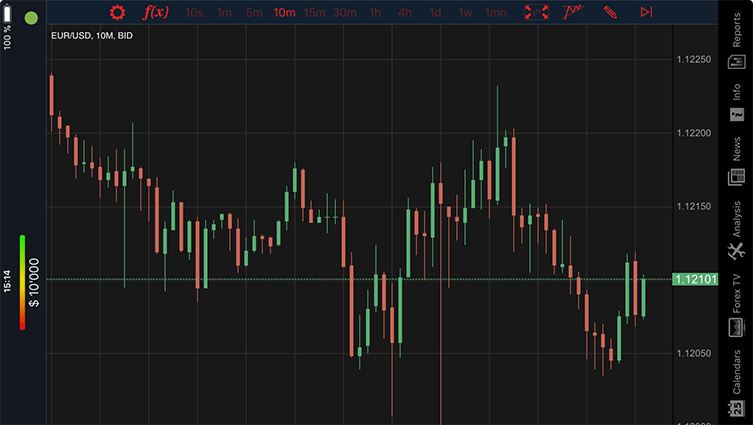

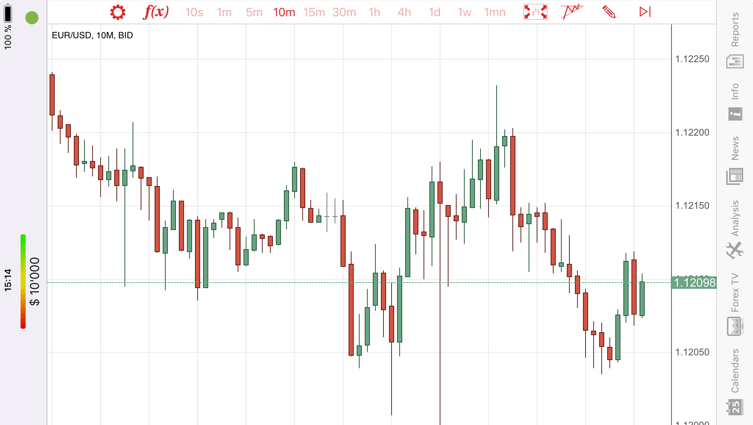

Controlla la cronologia dei migliori movimenti di prezzo BID/ASK. Crea qualsiasi grafico, inclusi Renko, Kagi o Line break, con impostazioni completamente personalizzabili, cosa molto importante anche per fare test su strategie automatizzate.

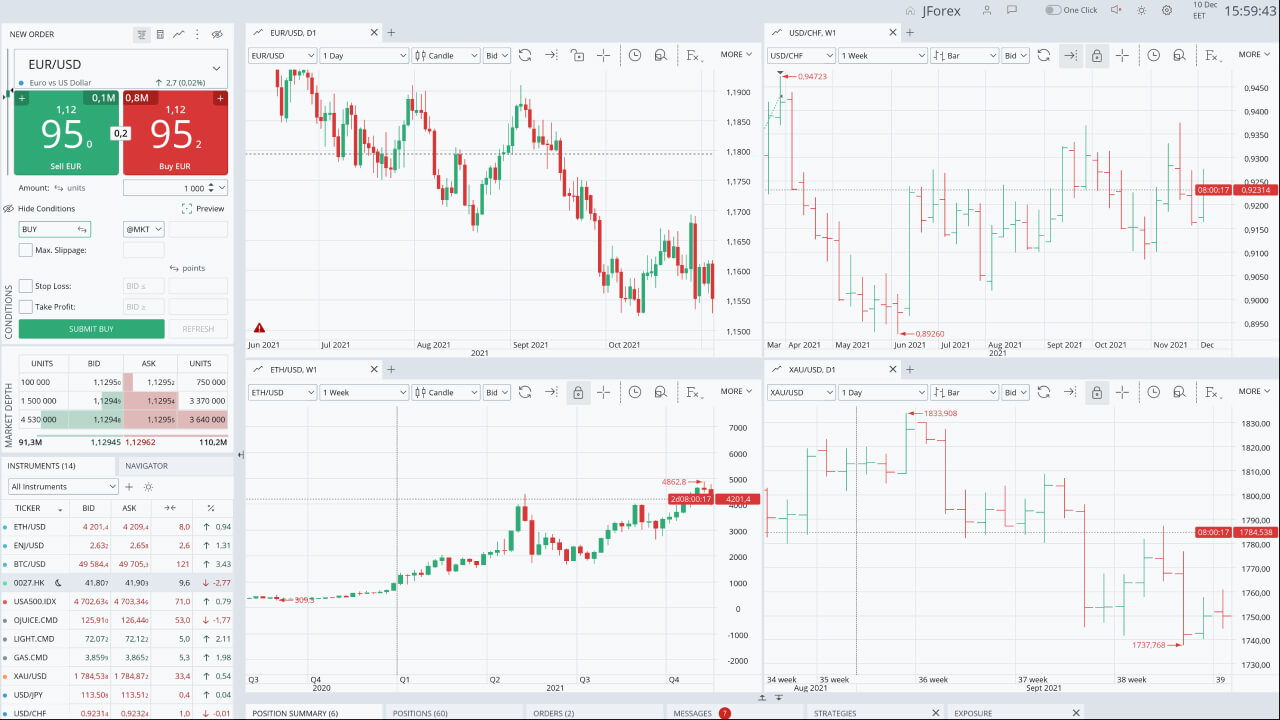

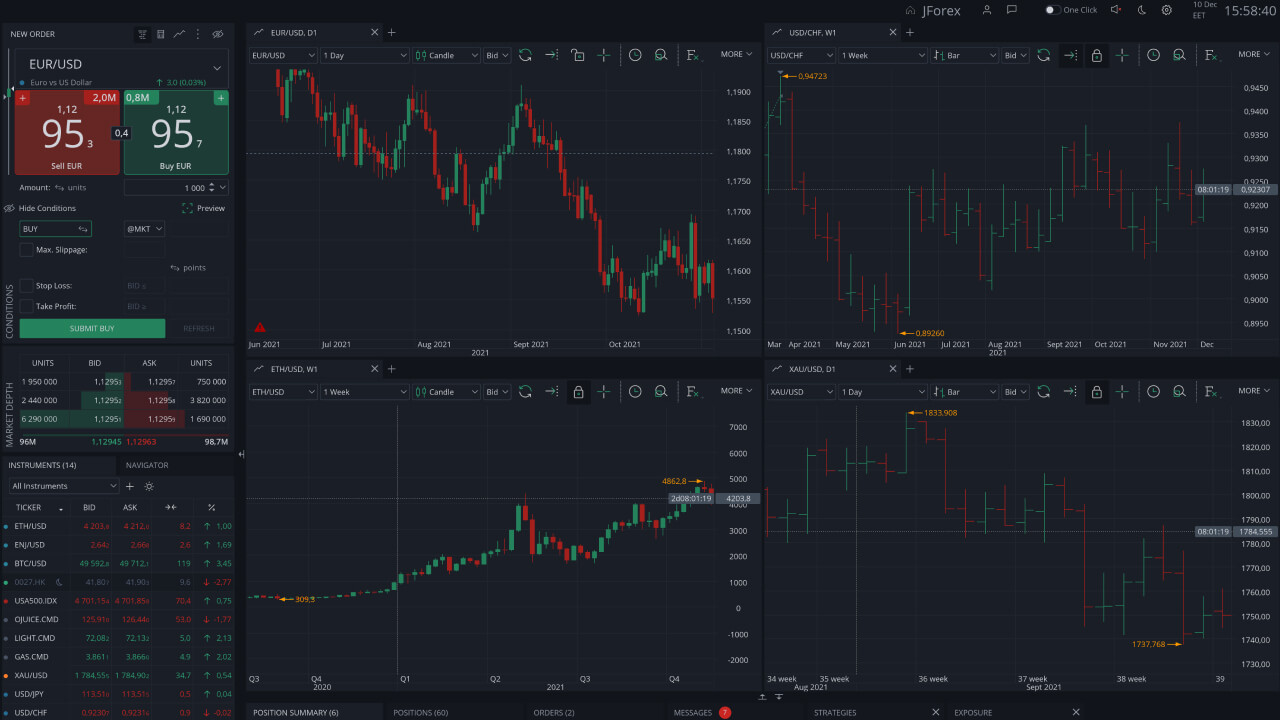

Utilizza l’apposita opzione per impostare il massimo slippage tollerato per gli ordini di mercato e per gli ordini stop. Impostalo su zero per eliminare completamente possibili esecuzioni peggiori del prezzo corrente.

Questo dettaglio aiuta i trader a determinare l'entità degli ordini di acquisto e di vendita a prezzi diversi. Mostra dove si concentra la maggior parte degli ordini.

Apri la tua piattaforma di trading su qualsiasi computer con il layout ed I template dei grafici sincronizzati.

Controlla i dati degli eventi economici e il loro impatto direttamente sul grafico.

Controlla la tua esposizione per asset, strumenti e posizioni. Costruisci le tue strategie di trading in modo più saggio.

Rispondi ai cambiamenti del mercato e controlla la distanza tra il prezzo di apertura, il prezzo corrente ed i livelli di Take Profit e Stop Loss. Il tutto in un solo e unico ambiente di trading

Una vasta selezione di indicatori e strumenti di disegno porta il tuo trading al livello successivo.

Aggiungi i tuoi strumenti Forex e CFD preferiti e segui I massimi e minimi giornalieri

| Funzionalità specifica a Dukascopy | JFOREX | Apple iOS | Web | Android |

|---|---|---|---|---|

| Controllo dello slippage | ||||

| Ordini BID/OFFER(4) | ||||

| Funzione Hedging | (1) | |||

| Funzione "Net Position(4)" | ||||

| Strumenti d'analisi tecnica | (2) | (2) | (2) | |

| Informazioni sul mercato e strumenti d'analisi | ||||

| Allerte di mercato | ||||

| Strumenti di comunicazione | ||||

| Trading automatizzato (strategies builder) | (3) | |||

| Interfaccia multilingue | ||||

| Parametri configurabli | ||||

| Frequenza degli updates set-up | ||||

| Ordini Trailing Stop | (1) | |||

| Funzione One-click |

Dukascopy si distingue nell'affollato panorama dei broker forex per il suo patrimonio bancario svizzero e l'impegno alla trasparenza. In quanto banca svizzera regolamentata, offre condizioni di trading di livello istituzionale che molti broker al dettaglio non possono semplicemente eguagliare.

La combinazione di affidabilità svizzera, tecnologia all'avanguardia e servizi incentrati sul trader rende Dukascopy particolarmente interessante per i trader seri che cercano un'esecuzione di livello professionale.

JForex 4 è la piattaforma personalizzata di Dukascopy ed è veramente ben progettata. Ciò che mi piace è che si rivolge sia ai principianti che ai trader esperti. L'interfaccia è fresca e moderna e gli strumenti analitici sono estremamente robusti. Inoltre, essendo stata sviluppata da una banca svizzera, ha un'atmosfera solida e senza fronzoli.

La storia della MT4 contro la MT5 è interessante. La MT4 esiste da sempre e c'è un motivo per cui è ancora così diffusa: funziona e basta. È semplice e affidabile, e tutti i broker la supportano. È come un vecchio amico affidabile che non la delude mai.

MT5 è l'aggiornamento di 'nuova generazione', che offre timeframe aggiuntivi, tipi di ordini più sofisticati e migliori strumenti di backtesting. Inoltre, si è estesa oltre il forex per includere azioni e materie prime, il che è ottimo se è interessato a questo settore.

Ecco il discorso vero e proprio: JForex 4 si sente premium e integrato — pensi alla banca svizzera — mentre MT4 è la scelta affidabile di tutti i giorni. MT5, invece, è per i trader che desiderano le funzioni più recenti e l'accesso a più mercati. Scelga in base a ciò che è più importante per il suo stile di trading.

Iniziare a fare trading può essere intimidatorio: qualsiasi piattaforma di trading forex può sembrare una scienza missilistica a prima vista. Ma ecco la verità incoraggiante: una volta trascorso un po' di tempo a fare clic e a scoprire dove si trovano gli indicatori e gli strumenti di personalizzazione, la maggior parte delle piattaforme diventa sorprendentemente maneggevole.

Il modo migliore per imparare è iniziare con un conto demo. È il suo parco giochi senza rischi, dove può sperimentare, sbagliare e imparare senza lo stress di perdere denaro reale o di rompere accidentalmente qualcosa di importante.

Su Dukascopy, i principianti hanno a disposizione alcune opzioni intelligenti. Se vuole concentrarsi esclusivamente sul forex senza essere sopraffatto dalla scelta, MT4 e MT5 sono ottimi punti di partenza. Mantengono le cose semplificate mentre sta imparando le regole. Una volta che si sente a suo agio e pronto ad esplorare oltre le valute - pensi ai CFD su materie prime, azioni e altri strumenti - JForex 4 apre un universo di trading più ampio.

Molti trader esperti utilizzano più di una piattaforma contemporaneamente. Questo è legale e spesso è una buona idea. Potrebbe utilizzare MT4 perché è affidabile, JForex 4 per i suoi fantastici grafici e l'applicazione mobile del suo broker per controllare rapidamente le sue posizioni quando è in giro.

Tenga presente le sfide che potrebbe affrontare: la gestione di più login, la potenziale confusione tra i conti e la potenza di calcolo necessaria per gestire senza problemi diverse piattaforme. Inizi con una piattaforma per imparare le basi, poi ne aggiunga altre man mano che la sua strategia di trading si sviluppa. Immagini di utilizzare strumenti diversi per lavori diversi – ogni piattaforma ha i suoi punti di forza e utilizzarli insieme può migliorare la sua esperienza di trading.

JForex 4 offers traders the opportunity to trade over 1500 instruments across eight asset classes, including forex and CFD. MT4 and MT5 provide access to 108 instruments, including popular currency pairs.

The best trading platform is dependent upon your experience, requirements, and preferences. Dukascopy offers a range of platforms, including MT5 and MT4, as well as the advanced JForex 4, each with distinct advantages for currency trading. MT4 and MT5 allow trading of up to 108 assets, while JForex 4 enables trading of over 1500 instruments. Research and compare features such as charting tools, mobile apps, and automated trading capabilities to find the platform that best suits you.

Online currency trading involves selecting a regulated forex broker, opening a trading account, and depositing funds. Once you have gained familiarity with the basics (pips, leverage, and margin), you can develop a trading strategy (technical or fundamental analysis) and practice with a demo account. When you are ready, you can start with small trades and utilize risk management tools like stop-loss orders to limit potential losses as you navigate the dynamic forex market.

Currency trading can be suitable for beginners, but it requires a solid understanding of the forex market and a disciplined approach. The market's high liquidity and potential for profit attract many new traders; however, the significant risks and volatility mean that thorough education and careful planning are essential. Beginners should start with a demo account to practice trading strategies without financial risk and gradually transition to live trading as they gain experience and confidence.

These are the simple steps to start trading:

If you want to learn currency trading, you need to start by studying the fundamentals. There are plenty of online courses, books, and tutorials out there that will teach you everything you need to know about the forex market, including the basics, technical and fundamental analysis, and trading strategies. Use a demo account offered by Dukascopy Bank to practice what you've learned. Additionally, join online trading communities, follow market news, and consider attending webinars or workshops to stay updated on market trends and deepen your understanding. Review and refine your strategies continuously, based on your experiences and evolving market conditions.

For beginners, major currency pairs, such as EUR/USD, USD/JPY, GBP/USD, might be a good starting point. These pairs tend to be more liquid (meaning easier to buy and sell) and have tighter spreads, which can be helpful when starting out. However, even these major pairs can be volatile, so it is advisable to prioritize education, risk management, and practicing with a demo account before risking real money.