The Stochastic indicator on the 4H and 1D time horizons points at a bearish market outbreak. Short traders could focus on the daily support level at 1.2534. If the pair breaches this level, next possible target could be at 1.2516.

Note: This section contains information in English only.

The Stochastic indicator on the 4H and 1D time horizons points at a bearish market outbreak. Short traders could focus on the daily support level at 1.2534. If the pair breaches this level, next possible target could be at 1.2516.

Thu, 07 Jun 2012 07:10:44 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

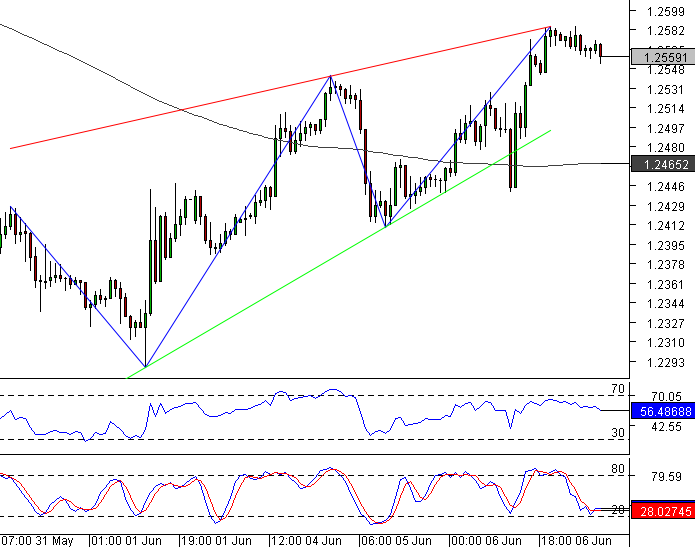

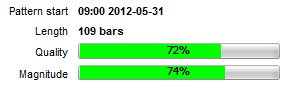

EUR/USD is recovering after dipping the lowest level this year and has formed a Rising Wedge pattern on the 1H chart. The pattern has 72% quality and 74% magnitude in the 109-bar period.

The pattern started when pair rebounded from 1.2428 and after testing support levels 1.2288 and 1.2411 it has slowed down at 1.2559 where the pair is currently trading. Aggregate indicators do not suggest clear emerging trends at any of the time horizons and market sentiment is equally divided between bears and bulls. Long traders could focus on the pattern resistance level at 1.2585. If this level is breached, next targets could be at a daily resistance level at 1.2603.

The Stochastic indicator on the 4H and 1D time horizons points at a bearish market outbreak. Short traders could focus on the daily support level at 1.2534. If the pair breaches this level, next possible target could be at 1.2516.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.