Note: This section contains information in English only.

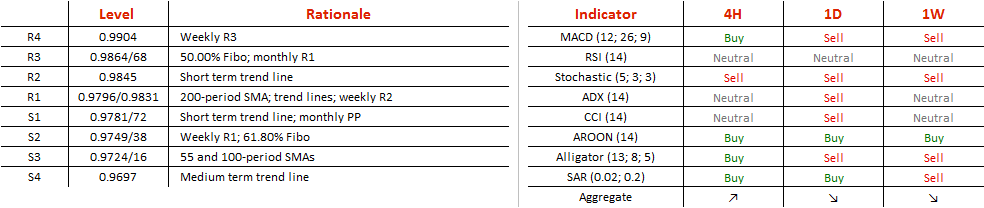

The Aussie is about to break out of a short term ascending channel pattern against the Canadian Dollar. The reason for that is that the currency exchange rate recently surged in accordance with the short term channel until it hit a strong resistance cluster. The main two levels of significance in the resistance cluster were the upper trend lines of the medium and long term patterns of the currency pair. The Australian Dollar is likely to break the short term channel against the Canadian Dollar and depreciate until the 0.9738 level, where the 61.80% Fibonacci retracement level is located at. The relevant Fibonacci retracement levels on this pair are measured by connecting the 2016 high and low levels. SWFX market sentiment supports this hypothesis, as 71% of trader open positions are long. That indicates at the pair being overbought.

The Aussie is about to break out of a short term ascending channel pattern against the Canadian Dollar. The reason for that is that the currency exchange rate recently surged in accordance with the short term channel until it hit a strong resistance cluster. The main two levels of significance in the resistance cluster were the upper trend lines of the medium and long term patterns of the currency pair. The Australian Dollar is likely to break the short term channel against the Canadian Dollar and depreciate until the 0.9738 level, where the 61.80% Fibonacci retracement level is located at. The relevant Fibonacci retracement levels on this pair are measured by connecting the 2016 high and low levels. SWFX market sentiment supports this hypothesis, as 71% of trader open positions are long. That indicates at the pair being overbought.

Thu, 12 Jan 2017 14:04:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.