Note: This section contains information in English only.

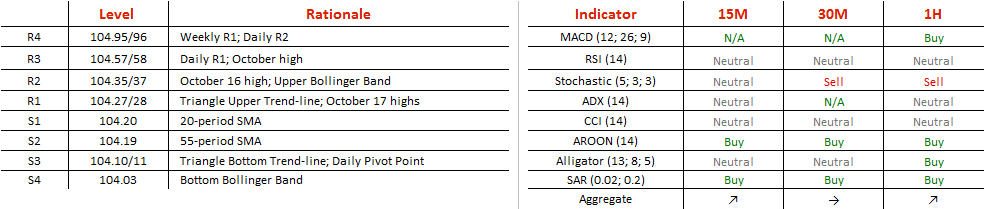

A correction of the bullish market trend was bound by a symmetrical triangle pattern, suggesting that the upper trend-line at 104.28 will break soon, extending the general rally. A rebound could target 104.36, shifting risk to 104.56 after execution. While on a short-term fall, USD/JPY will bounce form the daily Pivot Point – triangle bottom trend-line cluster at 104.08/10 with no significant obstacles throughout the pattern. On a larger scale, we do not see the pair topping 107.39, the July high, until mid-November. An overwhelming majority (63%) of bulls expecting gains from the USD/JPY currency pair, however, suggests that some downside pressures could weigh on the currency for it to reach equilibrium.

A correction of the bullish market trend was bound by a symmetrical triangle pattern, suggesting that the upper trend-line at 104.28 will break soon, extending the general rally. A rebound could target 104.36, shifting risk to 104.56 after execution. While on a short-term fall, USD/JPY will bounce form the daily Pivot Point – triangle bottom trend-line cluster at 104.08/10 with no significant obstacles throughout the pattern. On a larger scale, we do not see the pair topping 107.39, the July high, until mid-November. An overwhelming majority (63%) of bulls expecting gains from the USD/JPY currency pair, however, suggests that some downside pressures could weigh on the currency for it to reach equilibrium.

Mon, 17 Oct 2016 09:44:19 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.