Note: This section contains information in English only.

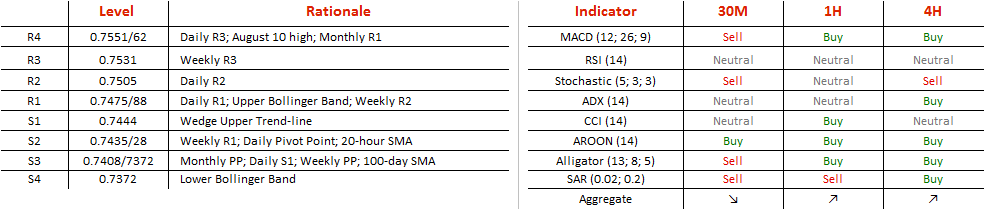

The descending wedge pattern AUD/CHF entered early August was broken at 0.7446 just hours ago, suggesting that a rally towards 0.7488 or 0.7531 will be cut off by the broken trend-line pulling the pair back for a rebound around 0.7435. With demand pressures stemming from underlying SMAs elevating the rate to 0.7505 and then 0.7531, the rally could be capped at 0.7558/0.7562, where a sell-off could signal either a reversal or a consolidation if restricted. Aggregate technical indicators support the expectation of a rally after the consolidation is completed.

The descending wedge pattern AUD/CHF entered early August was broken at 0.7446 just hours ago, suggesting that a rally towards 0.7488 or 0.7531 will be cut off by the broken trend-line pulling the pair back for a rebound around 0.7435. With demand pressures stemming from underlying SMAs elevating the rate to 0.7505 and then 0.7531, the rally could be capped at 0.7558/0.7562, where a sell-off could signal either a reversal or a consolidation if restricted. Aggregate technical indicators support the expectation of a rally after the consolidation is completed.

Wed, 28 Sep 2016 14:40:12 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.