Note: This section contains information in English only.

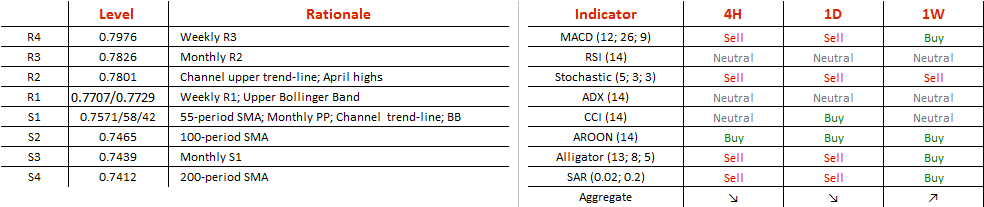

While an ascending channel has directed AUD/USD movements for the last four months, the multi-year channel down is likely to prove its dominance in the nearest future, implying a downtrend for the pair. The rate has just touched the upper trend-line of the weekly channel, implying a plunge towards the bottom of the pattern as well as a breakout from the daily channel is coming up. A downward breakout is more likely than an upward one, despite the repeated tests of the top trend-line that have led the currency to fail before, as well as the strong support from various time-frame SMAs that could push the pair up. In case the movements remain inside the weekly channel pattern, a southward breakout would cause the pair to dip to the 100-period SMA at 0.7465 and monthly R2 at 0.7439 consequently before a plunge towards the lower channel boundary at 0.6334. In the pattern is broken, the rate will break the 0.7801 level where April highs lie, with the monthly R2 as the next nearest target at 0.7826. A slightly oversold Australian Dollar as well as an optimistic reading from the weekly-and-longer term aggregate technical indicators imply that there is, however, reason to doubt the continuation of the trend.

While an ascending channel has directed AUD/USD movements for the last four months, the multi-year channel down is likely to prove its dominance in the nearest future, implying a downtrend for the pair. The rate has just touched the upper trend-line of the weekly channel, implying a plunge towards the bottom of the pattern as well as a breakout from the daily channel is coming up. A downward breakout is more likely than an upward one, despite the repeated tests of the top trend-line that have led the currency to fail before, as well as the strong support from various time-frame SMAs that could push the pair up. In case the movements remain inside the weekly channel pattern, a southward breakout would cause the pair to dip to the 100-period SMA at 0.7465 and monthly R2 at 0.7439 consequently before a plunge towards the lower channel boundary at 0.6334. In the pattern is broken, the rate will break the 0.7801 level where April highs lie, with the monthly R2 as the next nearest target at 0.7826. A slightly oversold Australian Dollar as well as an optimistic reading from the weekly-and-longer term aggregate technical indicators imply that there is, however, reason to doubt the continuation of the trend.

Tue, 30 Aug 2016 09:05:09 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.