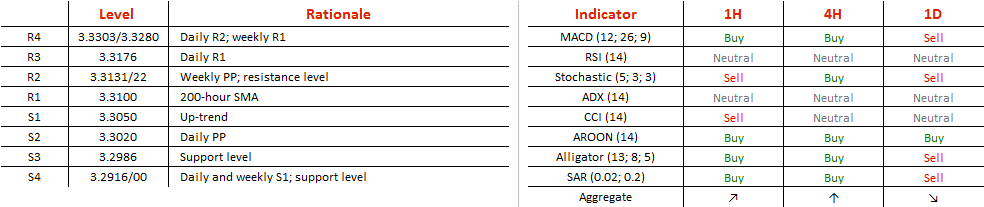

Nevertheless, in order to confirm the bullish scenario we still need to see a close above a massive supply area circa 3.31, which is strengthened by the long-term moving average. If this is not the case, we are likely to see a sell-off to 3.29.

Note: This section contains information in English only.

Judging by the technicals, EUR/TRY is ready to lunge at 3.3450, namely the four-week trendline. One of the main reasons to be long the Euro against the Lira is that the currency pair has formed an ascending triangle, a pattern that indicates growing demand. The positive bias is further reinforced by hourly and four-hour studies and the fact that the single currency is heavily oversold—71% of open positions are short.

Judging by the technicals, EUR/TRY is ready to lunge at 3.3450, namely the four-week trendline. One of the main reasons to be long the Euro against the Lira is that the currency pair has formed an ascending triangle, a pattern that indicates growing demand. The positive bias is further reinforced by hourly and four-hour studies and the fact that the single currency is heavily oversold—71% of open positions are short.

Nevertheless, in order to confirm the bullish scenario we still need to see a close above a massive supply area circa 3.31, which is strengthened by the long-term moving average. If this is not the case, we are likely to see a sell-off to 3.29.

Wed, 17 Aug 2016 07:12:03 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

Nevertheless, in order to confirm the bullish scenario we still need to see a close above a massive supply area circa 3.31, which is strengthened by the long-term moving average. If this is not the case, we are likely to see a sell-off to 3.29.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.