Note: This section contains information in English only.

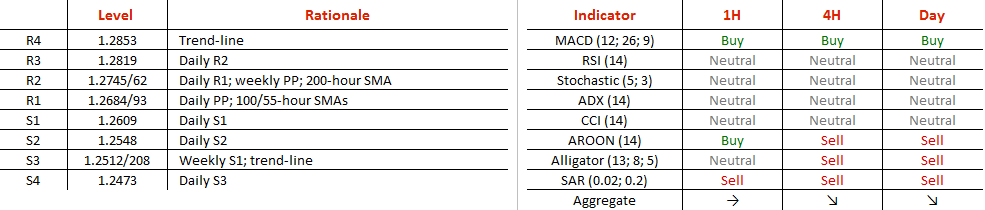

USD/CAD continues to recover for a fourth consecutive day this Monday, but the overall pip-measured gain has been limited so far. This is because the long-term expectations remain tilted to the downside due to strong boundaries of the channel down pattern. With 4H and daily technical indicators being bearish, the pair is forecasted to fail at 1.2840 or even below this level. Intermediate and quite dangerous resistance is placed between 1.2745 and 1.2762. Here the short-term daily R1 is boosted by the weekly pivot and 200-hour SMA. Over the course of this trading week, we might observe a slump towards the weekly S1, which is going to act as reliable support near 1.25.

USD/CAD continues to recover for a fourth consecutive day this Monday, but the overall pip-measured gain has been limited so far. This is because the long-term expectations remain tilted to the downside due to strong boundaries of the channel down pattern. With 4H and daily technical indicators being bearish, the pair is forecasted to fail at 1.2840 or even below this level. Intermediate and quite dangerous resistance is placed between 1.2745 and 1.2762. Here the short-term daily R1 is boosted by the weekly pivot and 200-hour SMA. Over the course of this trading week, we might observe a slump towards the weekly S1, which is going to act as reliable support near 1.25.

Mon, 25 Apr 2016 13:09:13 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.