Note: This section contains information in English only.

Fri, 25 Mar 2016 15:08:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

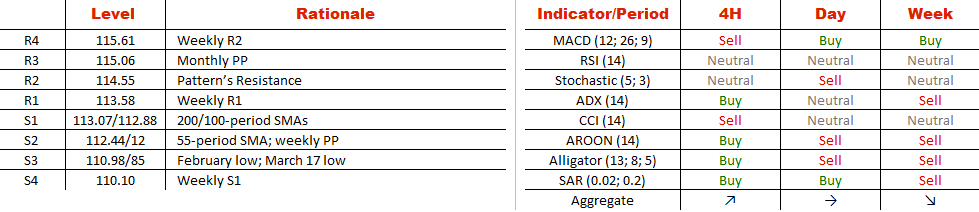

A double bottom that has emerged in the 4H chart for the USD/JPY currency pair is looking pretty much similar to the figure created by the previous cross. However, here the bulls are only getting ready to deal with the 200-period moving average line located just above the 113 level. An immediate failure here is not expected, also given that 4H technical studies are supporting the rally of the Greenback. However, much stronger selling pressure is forecasted to be seen near 115, the area between the upper boundary of the pattern and the monthly pivot point. It should be monitored carefully, as weekly indicators are pessimistic and the Dollar seems to be overbought (73% long sentiment).

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.