Note: This section contains information in English only.

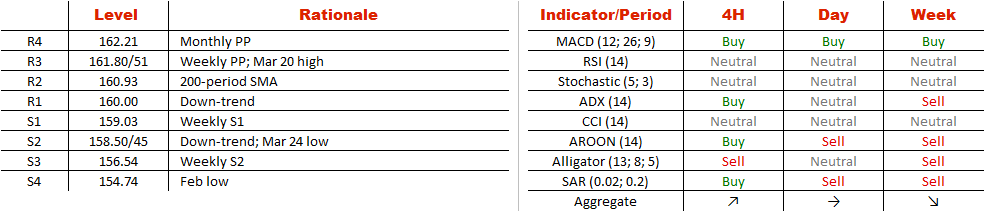

GBP/JPY finds itself in an equivocal situation. On the one hand, the currency pair is currently forming a falling wedge, a pattern that implies a rally. On the other hand, even if the price manages to jump over the resistance trend-line at 160 yen, long positions would still be highly risky. The reason is a large amount of obstacles that would lay in the recovery's path. The first to be encountered is the 200-period SMA at 160.93, followed by the monthly PP at 162.21 and finally by the major down-trend line at the level of 164 yen. At the same time, in case the Sterling slips under the lower boundary of the wedge and updates the March 24 low, the rate should slide down to the February low at 154.74 without any hindrance.

GBP/JPY finds itself in an equivocal situation. On the one hand, the currency pair is currently forming a falling wedge, a pattern that implies a rally. On the other hand, even if the price manages to jump over the resistance trend-line at 160 yen, long positions would still be highly risky. The reason is a large amount of obstacles that would lay in the recovery's path. The first to be encountered is the 200-period SMA at 160.93, followed by the monthly PP at 162.21 and finally by the major down-trend line at the level of 164 yen. At the same time, in case the Sterling slips under the lower boundary of the wedge and updates the March 24 low, the rate should slide down to the February low at 154.74 without any hindrance.

Fri, 25 Mar 2016 07:14:25 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.