Note: This section contains information in English only.

Thu, 24 Mar 2016 15:05:13 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

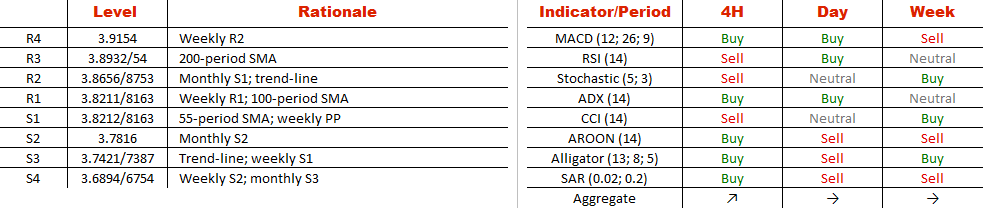

Two downward-sloping boundaries of the falling wedge pattern are gradually moving closer to each other, meaning the spread is declining. The base case scenario suggests the US Dollar is going to appreciate in the long run, but in the mid-term some bearishness still seems more probable. A formidable resistance is located near 3.90, where the upper edge of the pattern is boosted by the monthly S1 from below and by the 200-period SMA from above. This is the level, where we see a short-term cap for the Buck's rally. A new leg down will aim at the zone below 3.74, even though weekly technical indicators tend to neither agree nor disagree with such a future path of development.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.