Note: This section contains information in English only.

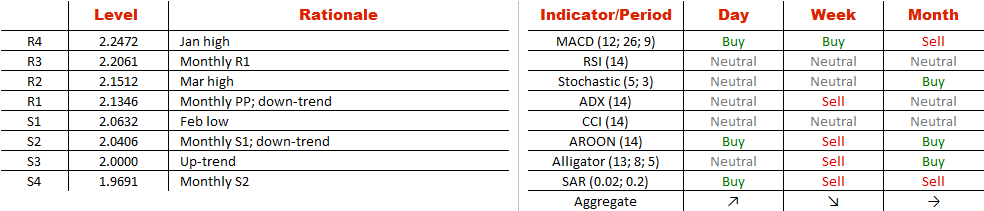

Considering that GBP/NZD is currently forming a well-defined falling wedge, the upside risks are increasing. However, the bullish break-out is not expected to transpire this month. The Sterling is to bounce off of the resistance trend-line at 2.1350 and then slide towards 2.00. There the pair will meet the long-term trend-line that connects the 2013 and 2015 lows. The test of this demand area should give the rate enough impetus to exit the pattern. In this case, the first target will be 2.15, represented by the March high, followed by the current 2016 high at 2.25. The SWFX sentiment is also against the immediate rally, as the Pound is overbought—71% of positions are long.

Considering that GBP/NZD is currently forming a well-defined falling wedge, the upside risks are increasing. However, the bullish break-out is not expected to transpire this month. The Sterling is to bounce off of the resistance trend-line at 2.1350 and then slide towards 2.00. There the pair will meet the long-term trend-line that connects the 2013 and 2015 lows. The test of this demand area should give the rate enough impetus to exit the pattern. In this case, the first target will be 2.15, represented by the March high, followed by the current 2016 high at 2.25. The SWFX sentiment is also against the immediate rally, as the Pound is overbought—71% of positions are long.

Mon, 21 Mar 2016 07:31:10 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.