Note: This section contains information in English only.

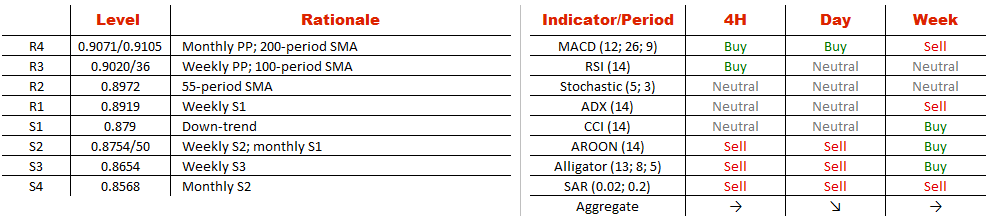

The New Zealand Dollar has been declining against its Canadian counterpart since the beginning of 2016, trading in a broadening falling wedge. The pair recently confirmed the wedge's support line and is now aiming to reach the upper boundary circa 0.93. However, daily technical studies suggest the exchange rate is to put the lower border to the test, but a breach is unlikely, as it is reinforced by the monthly S1. A strong resistance area is located around 0.9065 area, which can prevent the Kiwi from outperforming the Loonie. Nonetheless, the longer-term outlook is bullish, at least until price hits the 0.93 mark. Meanwhile, market sentiment is somewhat bearish, as 53% of traders currently hold short positions.

The New Zealand Dollar has been declining against its Canadian counterpart since the beginning of 2016, trading in a broadening falling wedge. The pair recently confirmed the wedge's support line and is now aiming to reach the upper boundary circa 0.93. However, daily technical studies suggest the exchange rate is to put the lower border to the test, but a breach is unlikely, as it is reinforced by the monthly S1. A strong resistance area is located around 0.9065 area, which can prevent the Kiwi from outperforming the Loonie. Nonetheless, the longer-term outlook is bullish, at least until price hits the 0.93 mark. Meanwhile, market sentiment is somewhat bearish, as 53% of traders currently hold short positions.

Fri, 11 Mar 2016 09:48:12 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.