Note: This section contains information in English only.

Thu, 10 Mar 2016 14:59:03 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

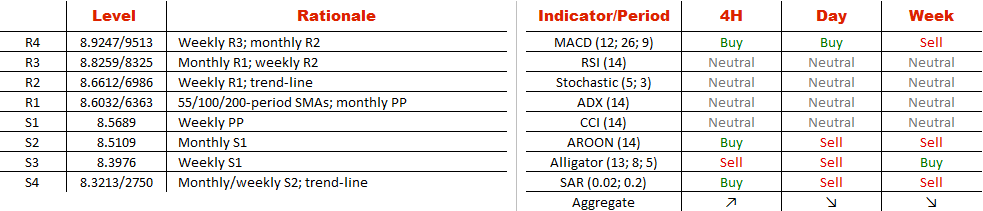

By trading inside the channel down pattern, the Dollar is expected to depreciate against the Norwegian Krone. The main obstacle is the first monthly support line at 8.5109, which risks stopping a decline at any point of time, especially noting the bullish four-hour technical studies and the fact that USD/NOK is heavily oversold in the SWFX market. At the moment of writing about three out of four market participants were keeping short open positions with respect to the Greenback. On the other hand, any advance will have a difficult time when trying to prolong beyond the cluster of simple moving averages around 8.60/61, reinforced by the monthly pivot point from above.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.