Note: This section contains information in English only.

Mon, 29 Feb 2016 14:33:16 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

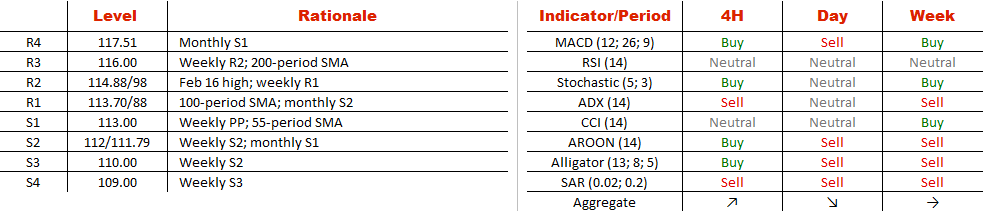

Long-term expectations are favouring the Dollar on the back of the Yen at the moment. By forming the double bottom reversal pattern, it proclaims that a more likely outcome is bullish one after this pattern is confirmed in the medium-term. To do that, the bulls are required to breach the 114.88 mark and also the weekly R1 from above. Another supply is offered by the 200-period SMA where USD/JPY has failed in early March last time. By going above 116, the next resistance will be 118, namely the weekly R3. However, considering the fact of bearish 4H indicators and mixed daily studies, the bearish case cannot be completely taken off the table. Any loss under 112 will risk re-testing two February lows at 111.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.