Note: This section contains information in English only.

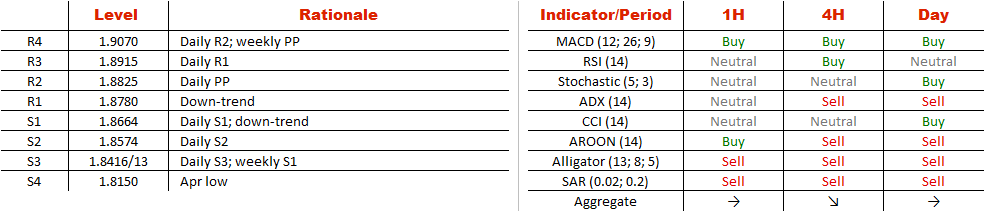

GBP/CAD is trading right at the apex of the falling wedge, implying the risks are heavily skewed to the upside. If resistance 1.8780 is broken, the first target will be the weekly pivot point at 1.9070, while in the long run we will expect the rally to extend towards 1.95, namely the major broken trend-line. However, the recovery might be stopped a little earlier by some 100-150 pips either by the 200-hour SMA or the weekly R1. Meanwhile, the bearish target is the weekly S1 at 1.8415, followed by the April low at 1.8150. An argument against a rally, however, is the sentiment in the market: 69% of the SWFX market participants are currently holding long positions, meaning the Sterling is overbought.

GBP/CAD is trading right at the apex of the falling wedge, implying the risks are heavily skewed to the upside. If resistance 1.8780 is broken, the first target will be the weekly pivot point at 1.9070, while in the long run we will expect the rally to extend towards 1.95, namely the major broken trend-line. However, the recovery might be stopped a little earlier by some 100-150 pips either by the 200-hour SMA or the weekly R1. Meanwhile, the bearish target is the weekly S1 at 1.8415, followed by the April low at 1.8150. An argument against a rally, however, is the sentiment in the market: 69% of the SWFX market participants are currently holding long positions, meaning the Sterling is overbought.

Mon, 29 Feb 2016 07:38:24 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.