In case the bulls overpower their counterparts, the focus will shift to the solid 0.7342/07 supply zone, which is capable of stopping any recovery. As for the sentiment in the SWFX market, the attitude towards CAD/CHF is only slightly bearish—44% of positions are long and 56% are short.

Note: This section contains information in English only.

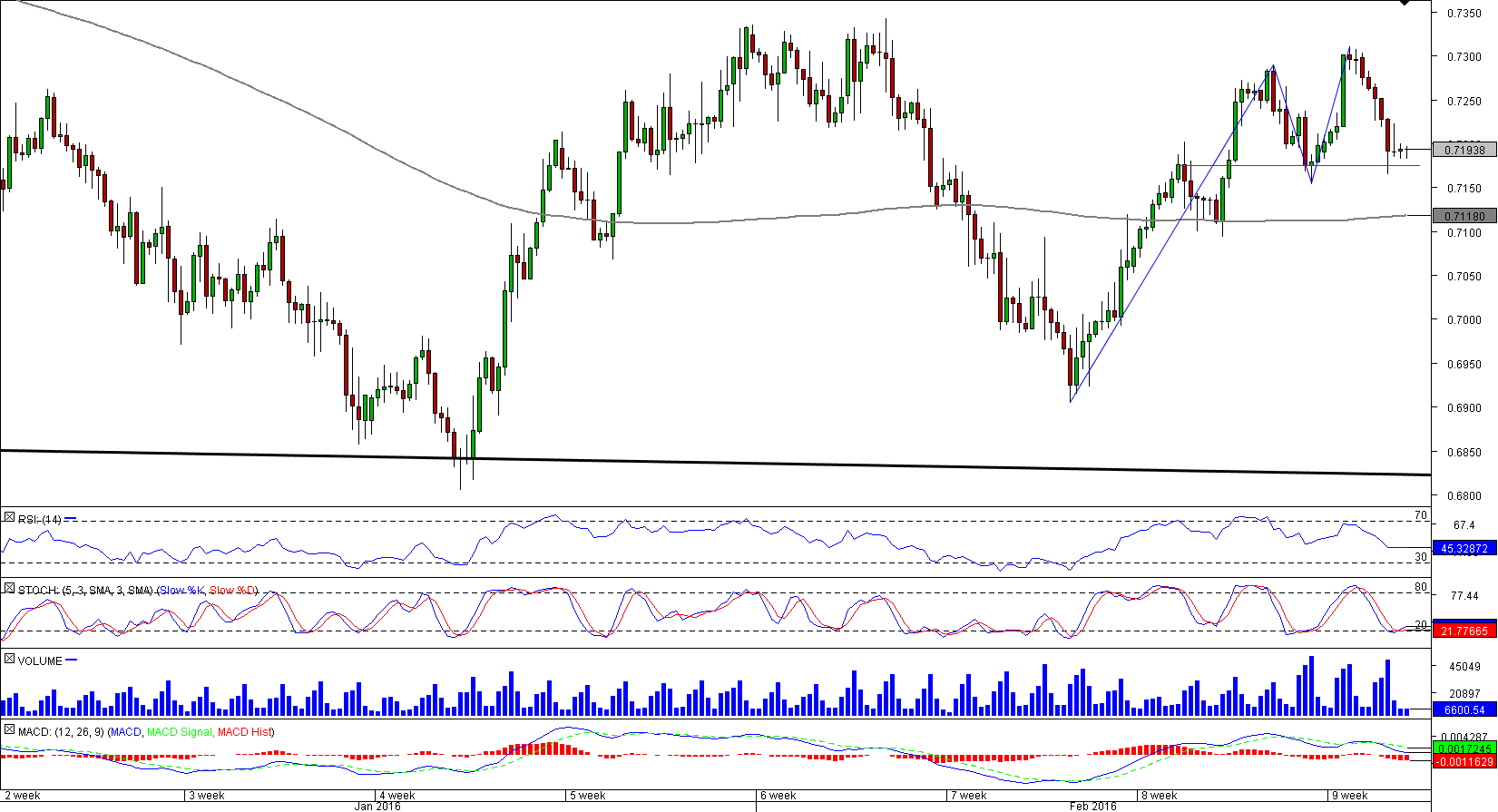

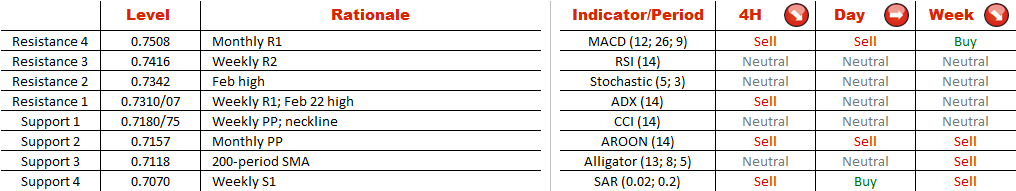

CAD/CHF is completing a double top in the middle of the major falling wedge (weekly chart). If the rate manages to close beneath the demand area at 0.7180/57, the pair will be set for a 150-pip decline. The technical studies confirm that this scenario is highly likely. However, there is also a notable support level at 0.7118, represented by the long-term moving average.

CAD/CHF is completing a double top in the middle of the major falling wedge (weekly chart). If the rate manages to close beneath the demand area at 0.7180/57, the pair will be set for a 150-pip decline. The technical studies confirm that this scenario is highly likely. However, there is also a notable support level at 0.7118, represented by the long-term moving average.

In case the bulls overpower their counterparts, the focus will shift to the solid 0.7342/07 supply zone, which is capable of stopping any recovery. As for the sentiment in the SWFX market, the attitude towards CAD/CHF is only slightly bearish—44% of positions are long and 56% are short.

Wed, 24 Feb 2016 06:34:07 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

In case the bulls overpower their counterparts, the focus will shift to the solid 0.7342/07 supply zone, which is capable of stopping any recovery. As for the sentiment in the SWFX market, the attitude towards CAD/CHF is only slightly bearish—44% of positions are long and 56% are short.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.