Note: This section contains information in English only.

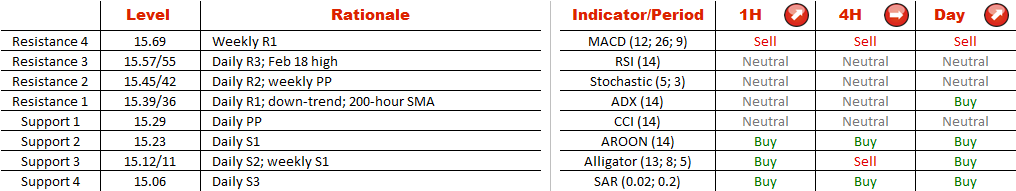

The outlook on silver is strongly bearish, being that it has recently tested the upper bound of the falling wedge in the weekly chart, though we should be wary of a potential rally, considering the nature of the long-term pattern. During the next few days, the metal is expected to cover the distance between the upper and lower trend-lines that form the short-term channel. Even though the hourly and daily technical indicators are bullish, the price should bounce off of 15.39/36 and fall about 60 cents before there is a notable upward correction. The distribution between the bulls and bears in the SWFX market is in favour of a sell-off, as the precious metal is overbought—74% of open positions are long.

The outlook on silver is strongly bearish, being that it has recently tested the upper bound of the falling wedge in the weekly chart, though we should be wary of a potential rally, considering the nature of the long-term pattern. During the next few days, the metal is expected to cover the distance between the upper and lower trend-lines that form the short-term channel. Even though the hourly and daily technical indicators are bullish, the price should bounce off of 15.39/36 and fall about 60 cents before there is a notable upward correction. The distribution between the bulls and bears in the SWFX market is in favour of a sell-off, as the precious metal is overbought—74% of open positions are long.

Wed, 24 Feb 2016 06:23:03 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.