Note: This section contains information in English only.

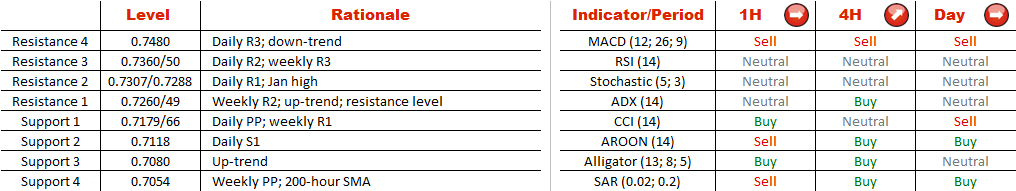

As AUD/CHF has just bumped into the rising resistance line, the near-term outlook is bearish. The currency pair is expected to dip under the weekly R1 and keep descending until it finds support at 0.7080. In the one or two-week perspective, however, the Aussie is bullish. The price is likely to continue fluctuating with an upward bias within the boundaries of the pattern. Meanwhile, the pair is approaching the upper trend-line of the four-year descending channel in the weekly chart. Accordingly, any attempts of AUD/CHF to rally beyond 0.7450/00 should fail. Another argument against a prolonged recovery is the fact that the Australian Dollar is overbought—74% of open positions are long.

As AUD/CHF has just bumped into the rising resistance line, the near-term outlook is bearish. The currency pair is expected to dip under the weekly R1 and keep descending until it finds support at 0.7080. In the one or two-week perspective, however, the Aussie is bullish. The price is likely to continue fluctuating with an upward bias within the boundaries of the pattern. Meanwhile, the pair is approaching the upper trend-line of the four-year descending channel in the weekly chart. Accordingly, any attempts of AUD/CHF to rally beyond 0.7450/00 should fail. Another argument against a prolonged recovery is the fact that the Australian Dollar is overbought—74% of open positions are long.

Tue, 23 Feb 2016 14:24:06 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.