Note: This section contains information in English only.

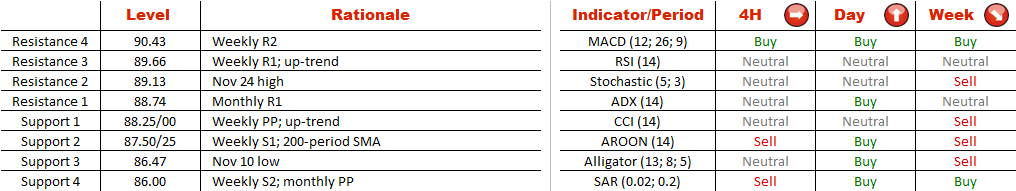

AUD/JPY is approaching the lower boundary of the recently formed channel, meaning the outlook on the pair is bullish both in the short and long terms. The price is expected to bottom out near 88.25/00 and start a recovery. The first resistance in this case will be the monthly R1 at 88.74, followed by a more important level at 89.13. The counter-arguments are the facts that the market is overbought (72% of positions are long) and the weekly indicators are bearish. If support at 88.00 is insufficient to stop the sell-off, the focus will shift to 87.50/25, where the weekly S1 merges with the 200-period SMA. Additional support will be only at 86.50, represented by the Nov 10 low.

AUD/JPY is approaching the lower boundary of the recently formed channel, meaning the outlook on the pair is bullish both in the short and long terms. The price is expected to bottom out near 88.25/00 and start a recovery. The first resistance in this case will be the monthly R1 at 88.74, followed by a more important level at 89.13. The counter-arguments are the facts that the market is overbought (72% of positions are long) and the weekly indicators are bearish. If support at 88.00 is insufficient to stop the sell-off, the focus will shift to 87.50/25, where the weekly S1 merges with the 200-period SMA. Additional support will be only at 86.50, represented by the Nov 10 low.

Fri, 27 Nov 2015 08:03:26 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.