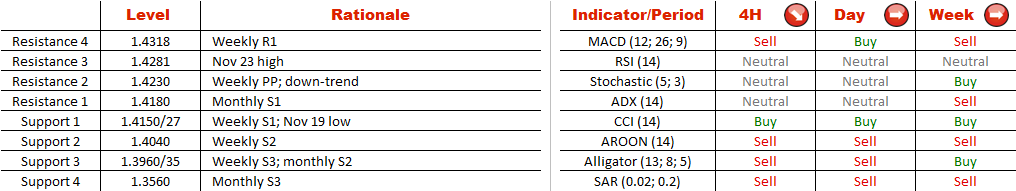

On the other hand, a rally through the falling resistance line at 1.4230 will invalidate the negative bias, and the focus will shift on resistances, such as the Nov 23 high at 1.4280, weekly R1 at 1.4318 and Nov 12 high at 1.4390.

Note: This section contains information in English only.

The outlook on EUR/CAD is currently bearish. The currency pair has remained in a strong down-trend since the end of September, and it has formed a descending triangle, which implies that demand for the Euro is weakening. We expect the price to close beneath 1.4150/27 and then continue going lower. The initial support will be at 1.4040 (weekly S2), but the main target will be a combination of the weekly S3 and monthly S2 at 1.3960/35.

The outlook on EUR/CAD is currently bearish. The currency pair has remained in a strong down-trend since the end of September, and it has formed a descending triangle, which implies that demand for the Euro is weakening. We expect the price to close beneath 1.4150/27 and then continue going lower. The initial support will be at 1.4040 (weekly S2), but the main target will be a combination of the weekly S3 and monthly S2 at 1.3960/35.

On the other hand, a rally through the falling resistance line at 1.4230 will invalidate the negative bias, and the focus will shift on resistances, such as the Nov 23 high at 1.4280, weekly R1 at 1.4318 and Nov 12 high at 1.4390.

Wed, 25 Nov 2015 08:27:13 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

On the other hand, a rally through the falling resistance line at 1.4230 will invalidate the negative bias, and the focus will shift on resistances, such as the Nov 23 high at 1.4280, weekly R1 at 1.4318 and Nov 12 high at 1.4390.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.