Note: This section contains information in English only.

Mon, 23 Nov 2015 14:12:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

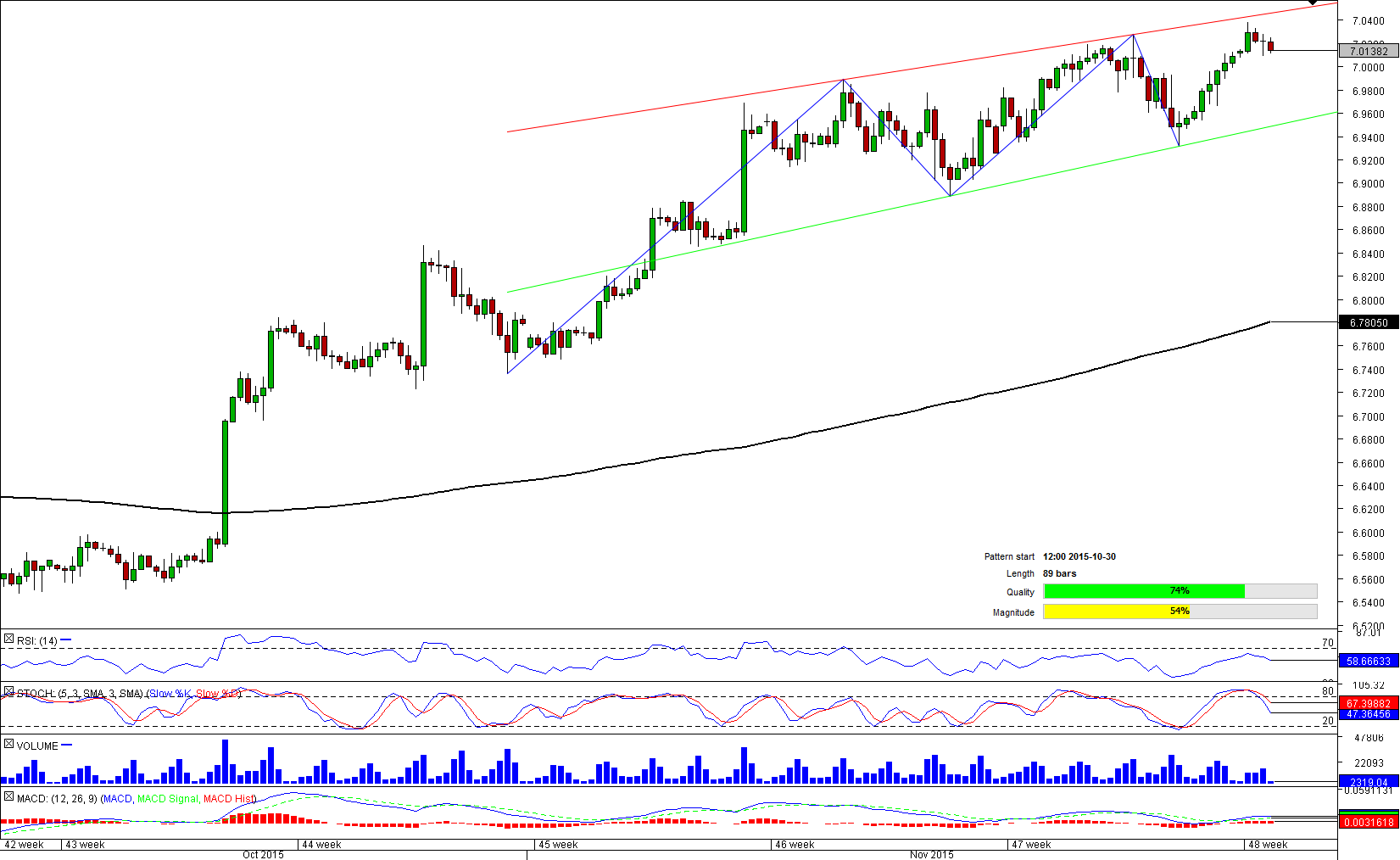

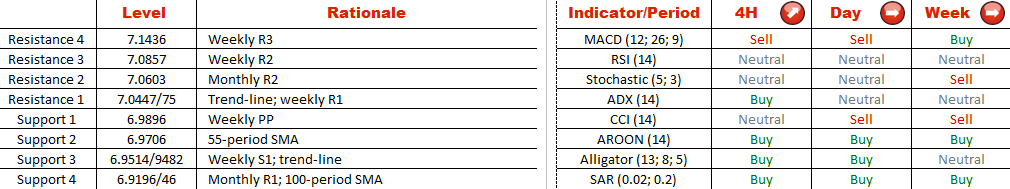

Danish Krone has been weakening with the Euro due to its peg to the single currency, meaning USD/DKK's appreciation is justified. However, in the short term this pair is estimated to commence a downward correction, by tumbling down from 7.04. Target bearish level is 6.95, where weekly S1 is guarding the lower trend-line of the pattern. US Dollar also seems to be overbought at the moment, being that 71% of all open positions are long. Daily and weekly technical indicators are mixed right now and they have no clear opinion on the matter. In case a drop takes place, the USD/DKK cross will have to penetrate Nov 10 high at 6.99 and 55-period SMA at 6.97, before finally approaching the trend-line.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.