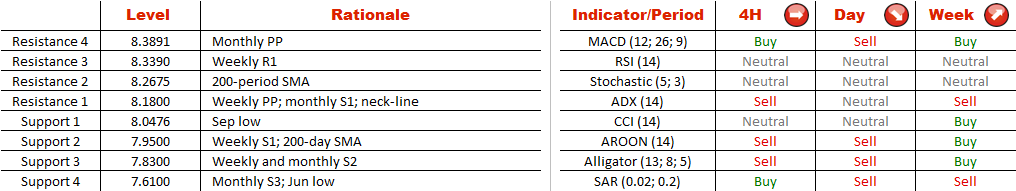

At the same time, a close beneath 8.05 will invalidate this scenario, and we will then wait for a test of the 200-day SMA at 7.95.

Note: This section contains information in English only.

USD/NOK has formed a double bottom at the end of the Sep 28-Oct 12 sell-off, meaning the Dollar is now well-positioned to negate these losses. The pattern and the bullish outlook will be confirmed when the currency pair gains a solid foothold above 8.1970/8.1750, a dense supply area created by the Oct 13 high, monthly S1 and weekly PP. If this is the case, the first major target will be the 200-period moving average at 8.2675, but given the height of the pattern the rally will likely extend higher, potentially up to 8.32.

USD/NOK has formed a double bottom at the end of the Sep 28-Oct 12 sell-off, meaning the Dollar is now well-positioned to negate these losses. The pattern and the bullish outlook will be confirmed when the currency pair gains a solid foothold above 8.1970/8.1750, a dense supply area created by the Oct 13 high, monthly S1 and weekly PP. If this is the case, the first major target will be the 200-period moving average at 8.2675, but given the height of the pattern the rally will likely extend higher, potentially up to 8.32.

At the same time, a close beneath 8.05 will invalidate this scenario, and we will then wait for a test of the 200-day SMA at 7.95.

Fri, 16 Oct 2015 05:04:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

At the same time, a close beneath 8.05 will invalidate this scenario, and we will then wait for a test of the 200-day SMA at 7.95.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.