Note: This section contains information in English only.

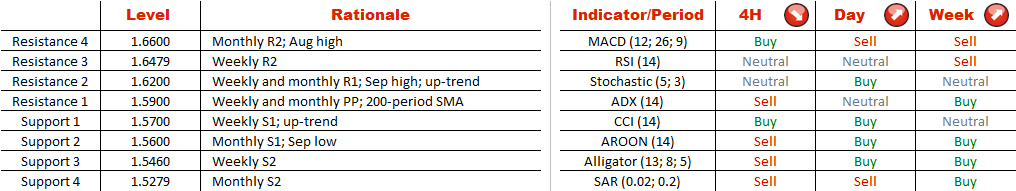

EUR/AUD appears to have formed a bullish channel, and there are plenty of other reasons why the currency pair is likely to rebound from 1.57. Apart from the fact that the price is now testing the rising support line, strong demand nearby is also implied by the monthly S1 and September low at 1.56. Moreover, most of the technical indicators in the daily and weekly charts are pointing upwards. Accordingly, the base case scenario is a rally from 1.57 up to 1.62, where the Euro is expected to meet the upper boundary of the pattern. At the same time, a dive under 1.56 will likely lead to an extension of the decline through the monthly S2 at 1.5280 and down to the August low at 1.47.

EUR/AUD appears to have formed a bullish channel, and there are plenty of other reasons why the currency pair is likely to rebound from 1.57. Apart from the fact that the price is now testing the rising support line, strong demand nearby is also implied by the monthly S1 and September low at 1.56. Moreover, most of the technical indicators in the daily and weekly charts are pointing upwards. Accordingly, the base case scenario is a rally from 1.57 up to 1.62, where the Euro is expected to meet the upper boundary of the pattern. At the same time, a dive under 1.56 will likely lead to an extension of the decline through the monthly S2 at 1.5280 and down to the August low at 1.47.

Wed, 07 Oct 2015 07:08:34 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.