If demand between 3.03 and 3.02 is not enough to trigger a rally, the sell-off will be expected to extend to one of the prominent September lows at 2.9757. Meanwhile, 63% of the SWFX traders are short the Dollar against the Turkish Lira.

Note: This section contains information in English only.

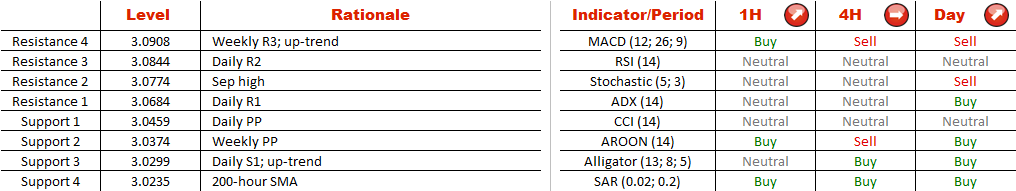

The pattern itself might not be well-defined, but the support trend-line appears to be reliable, and right now this is the main reason to be bullish USD/TRY. Additional signals are provided by the technicals. The pair is expected to reach 3.09, namely the upper boundary pattern before it dips beneath 3.03, a breach of which will invalidate the bullish outlook. Still, we should also take into account solid resistance at 3.0774, represented by the September high.

The pattern itself might not be well-defined, but the support trend-line appears to be reliable, and right now this is the main reason to be bullish USD/TRY. Additional signals are provided by the technicals. The pair is expected to reach 3.09, namely the upper boundary pattern before it dips beneath 3.03, a breach of which will invalidate the bullish outlook. Still, we should also take into account solid resistance at 3.0774, represented by the September high.

If demand between 3.03 and 3.02 is not enough to trigger a rally, the sell-off will be expected to extend to one of the prominent September lows at 2.9757. Meanwhile, 63% of the SWFX traders are short the Dollar against the Turkish Lira.

Mon, 28 Sep 2015 06:07:39 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

If demand between 3.03 and 3.02 is not enough to trigger a rally, the sell-off will be expected to extend to one of the prominent September lows at 2.9757. Meanwhile, 63% of the SWFX traders are short the Dollar against the Turkish Lira.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.