Note: This section contains information in English only.

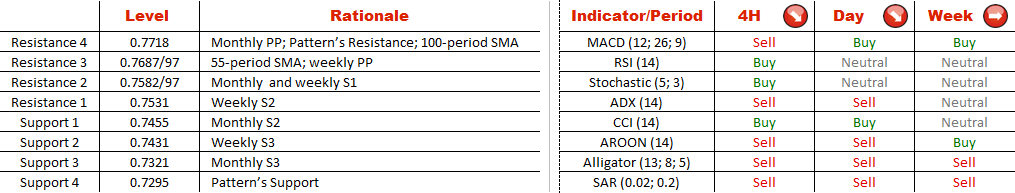

The Aussie/Greenback currency pair has a greater chance of losing value inside the channel down pattern, compared with the previously discussed cross, even though its market sentiment is even more bullish at 71% for long traders. The main reason for a negative outlook is the long-term tendency of the Australian Dollar to depreciate. Moreover, the pair is trading below all 55, 100 and 200-period SMAs, as well as many other major technical levels. Moreover, 4H and daily studies are pointing to the downside, assuming at least a near term decline. The main target for bears seems to be the monthly S2 at 0.7455, followed by the monthly S3 and pattern's support around 0.73.

The Aussie/Greenback currency pair has a greater chance of losing value inside the channel down pattern, compared with the previously discussed cross, even though its market sentiment is even more bullish at 71% for long traders. The main reason for a negative outlook is the long-term tendency of the Australian Dollar to depreciate. Moreover, the pair is trading below all 55, 100 and 200-period SMAs, as well as many other major technical levels. Moreover, 4H and daily studies are pointing to the downside, assuming at least a near term decline. The main target for bears seems to be the monthly S2 at 0.7455, followed by the monthly S3 and pattern's support around 0.73.

Fri, 03 Jul 2015 13:34:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.