Note: This section contains information in English only.

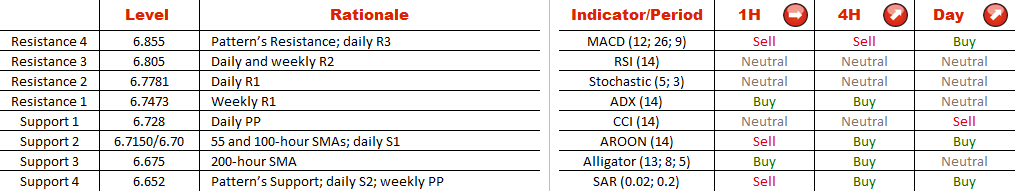

The USD/DKK currency pair is planning to approach gradually the upper boundary of the channel up pattern. The pair has been rallying in the past four days, after a correction was halted by the 200-hour SMA around 6.62. Meanwhile, the Greenback has already crossed both 55 and 100-hour simple moving averages, and the most important obstacle is now represented by the weekly R1 at 6.7473. In case this mark is penetrated, the focus will turn to the next supply at 6.8050 (daily and weekly R2), which are followed by the pattern's resistance at 6.8524. Meanwhile, 4H and daily indicators are bullish at the moment, and the majority of traders (72%) hold long open positions on the US Dollar.

The USD/DKK currency pair is planning to approach gradually the upper boundary of the channel up pattern. The pair has been rallying in the past four days, after a correction was halted by the 200-hour SMA around 6.62. Meanwhile, the Greenback has already crossed both 55 and 100-hour simple moving averages, and the most important obstacle is now represented by the weekly R1 at 6.7473. In case this mark is penetrated, the focus will turn to the next supply at 6.8050 (daily and weekly R2), which are followed by the pattern's resistance at 6.8524. Meanwhile, 4H and daily indicators are bullish at the moment, and the majority of traders (72%) hold long open positions on the US Dollar.

Thu, 02 Jul 2015 13:30:06 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.