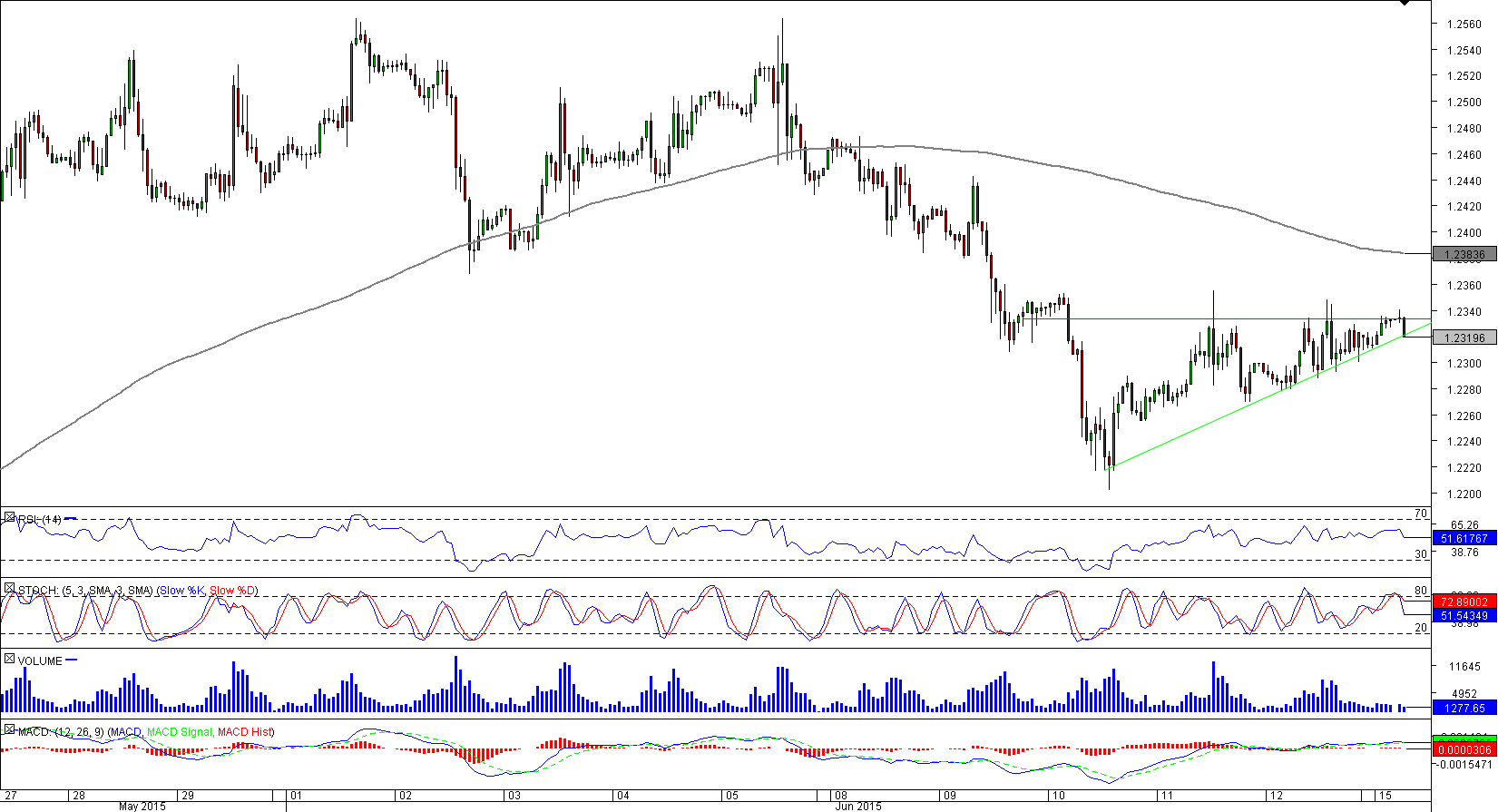

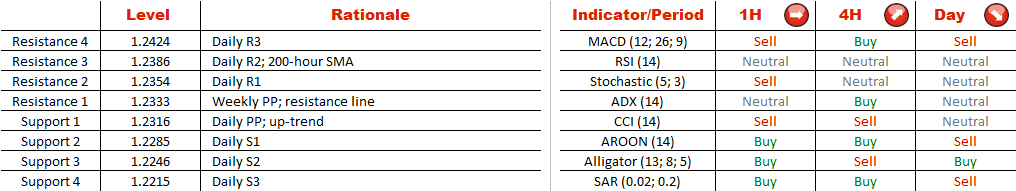

If the rate closes above 1.2333, the initial target will be the 200-hour SMA at 1.2386, where it merges with the daily R2, and there will be a real chance of a surge up to 1.2463 (weekly R1). As for the break-out to the downside, the main target will be the Jun 10 low at 1.22, but there are likely to be short-term corrections at the pivot points.

Note: This section contains information in English only.

USD/CAD is ready to break out of the pattern. However, the signals are conflicting. The pattern itself indicates that the demand is building up. On the other hand, for a few days before the ascending triangle the market was bearish, and the price is below the long-term SMA. At the same time, the technical studies are mixed.

USD/CAD is ready to break out of the pattern. However, the signals are conflicting. The pattern itself indicates that the demand is building up. On the other hand, for a few days before the ascending triangle the market was bearish, and the price is below the long-term SMA. At the same time, the technical studies are mixed.

If the rate closes above 1.2333, the initial target will be the 200-hour SMA at 1.2386, where it merges with the daily R2, and there will be a real chance of a surge up to 1.2463 (weekly R1). As for the break-out to the downside, the main target will be the Jun 10 low at 1.22, but there are likely to be short-term corrections at the pivot points.

Mon, 15 Jun 2015 07:55:21 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

If the rate closes above 1.2333, the initial target will be the 200-hour SMA at 1.2386, where it merges with the daily R2, and there will be a real chance of a surge up to 1.2463 (weekly R1). As for the break-out to the downside, the main target will be the Jun 10 low at 1.22, but there are likely to be short-term corrections at the pivot points.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.