Note: This section contains information in English only.

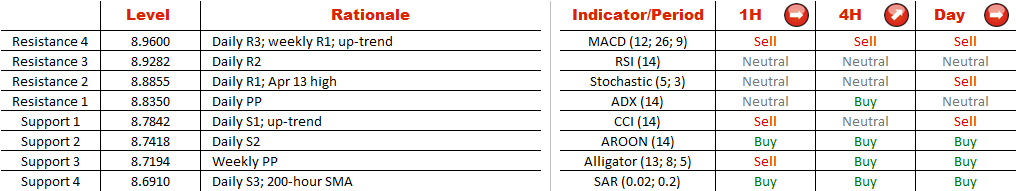

Not only does USD/SEK look bullish on the daily chart, but the short-term outlook appears to be positive as well. The currency pair has just confirmed the lower trend-line of the channel, meaning the next objective is the resistance at 8.96, which is reinforced by the daily R3 and weekly R1 levels. However, there is a notable obstacle at 8.8855, which might postpone a recovery. Meanwhile, a close beneath 8.7842 will likely mean a sell-off to the weekly pivot point at 8.72, and additional support is seen at 8.69 (daily S3 and 200-hour SMA). As for the longer-term perspective, the US Dollar is currently moving towards the 2009 high at 9.33.

Not only does USD/SEK look bullish on the daily chart, but the short-term outlook appears to be positive as well. The currency pair has just confirmed the lower trend-line of the channel, meaning the next objective is the resistance at 8.96, which is reinforced by the daily R3 and weekly R1 levels. However, there is a notable obstacle at 8.8855, which might postpone a recovery. Meanwhile, a close beneath 8.7842 will likely mean a sell-off to the weekly pivot point at 8.72, and additional support is seen at 8.69 (daily S3 and 200-hour SMA). As for the longer-term perspective, the US Dollar is currently moving towards the 2009 high at 9.33.

Tue, 14 Apr 2015 07:11:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.