Note: This section contains information in English only.

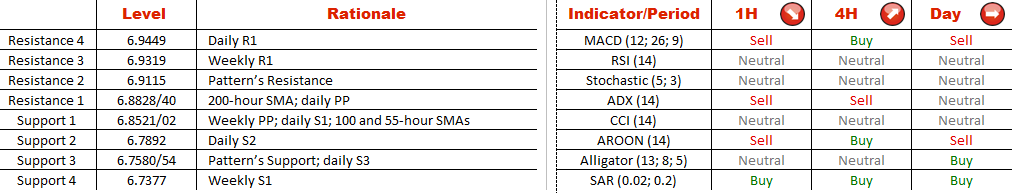

A recent attempt of the US Dollar to rebound versus the Danish Krona was stopped by the 6.92 mark, which is reinforced by weekly and daily R1 from above. As a result of that, USD/DKK has finally formed a channel down pattern and is now heading to the south. Being that 200-hour SMA and daily PP have already been eliminated, the most difficult obstacle is currently located around 6.8550 (weekly PP; daily S1; 100-hour SMA). If the cross manages to breach this strong demand zone, we should expect the pair to drop as low as pattern's support at 6.75 in a few days. On the contrary, a failure to cross support area will give a second chance to the Greenback to jump, as suggested by 70% of SWFX traders.

A recent attempt of the US Dollar to rebound versus the Danish Krona was stopped by the 6.92 mark, which is reinforced by weekly and daily R1 from above. As a result of that, USD/DKK has finally formed a channel down pattern and is now heading to the south. Being that 200-hour SMA and daily PP have already been eliminated, the most difficult obstacle is currently located around 6.8550 (weekly PP; daily S1; 100-hour SMA). If the cross manages to breach this strong demand zone, we should expect the pair to drop as low as pattern's support at 6.75 in a few days. On the contrary, a failure to cross support area will give a second chance to the Greenback to jump, as suggested by 70% of SWFX traders.

Wed, 08 Apr 2015 12:58:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.