Note: This section contains information in English only.

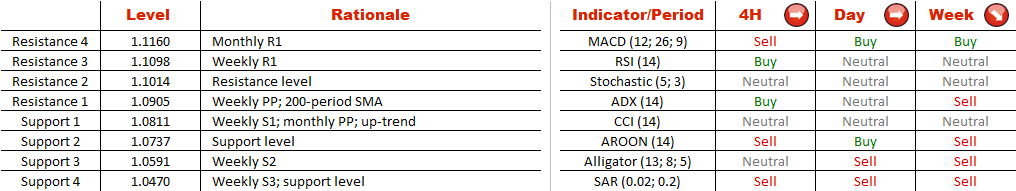

While every recent rally ended around 1.10, every subsequent sell-off was smaller than the previous one. Judging by these latest developments, demand for the Euro is currently building up. However, there is also a possibility of a double top pattern emerging, if the up-trend at 1.08 does not withstand the selling pressure. Then we will be looking at 1.0737 as a key support level, a breach of which will imply a decline to 1.0470. Conversely, if supply at 1.10 is overcome first, then the nearest target will be 1.1275, followed by 1.1488, though we should also remember about the monthly R1 level at 1.1160. Still, the sentiment is bearish, as a majority (57%) of positions is short.

While every recent rally ended around 1.10, every subsequent sell-off was smaller than the previous one. Judging by these latest developments, demand for the Euro is currently building up. However, there is also a possibility of a double top pattern emerging, if the up-trend at 1.08 does not withstand the selling pressure. Then we will be looking at 1.0737 as a key support level, a breach of which will imply a decline to 1.0470. Conversely, if supply at 1.10 is overcome first, then the nearest target will be 1.1275, followed by 1.1488, though we should also remember about the monthly R1 level at 1.1160. Still, the sentiment is bearish, as a majority (57%) of positions is short.

Wed, 08 Apr 2015 06:44:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.