Note: This section contains information in English only.

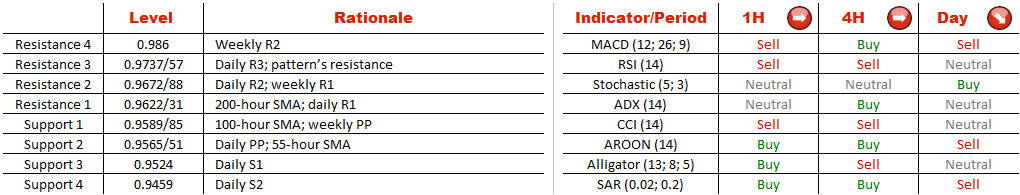

A decline of USD/CHF pair that lasted since March 17, was stopped by the major level at 0.95. Following that, the US Dollar started trading sideways against the Swiss Franc in the range up to 0.9750, which eventually led to emergence of the double bottom pattern. At the moment the pair is heading towards the top between two valleys, by trying to penetrate the 200-hour SMA right now. SWFX market participants are supporting the bullish case for this currency pair, as more than 71% of all opened positions are long. However, 1H and 4H technicals are neutral, while daily ones are pointing to the downside, meaning that we may observe an appearance of the rectangle pattern in medium-term.

A decline of USD/CHF pair that lasted since March 17, was stopped by the major level at 0.95. Following that, the US Dollar started trading sideways against the Swiss Franc in the range up to 0.9750, which eventually led to emergence of the double bottom pattern. At the moment the pair is heading towards the top between two valleys, by trying to penetrate the 200-hour SMA right now. SWFX market participants are supporting the bullish case for this currency pair, as more than 71% of all opened positions are long. However, 1H and 4H technicals are neutral, while daily ones are pointing to the downside, meaning that we may observe an appearance of the rectangle pattern in medium-term.

Tue, 07 Apr 2015 12:15:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.