In the meantime, the support trend-line is at 8.5518, and it must remain intact. Otherwise, the Euro will be exposed to a drop to the Mar 6 low at 8.5104. Another demand area is supposed to be at 8.48, implied by one of the long-term trend-lines.

Note: This section contains information in English only.

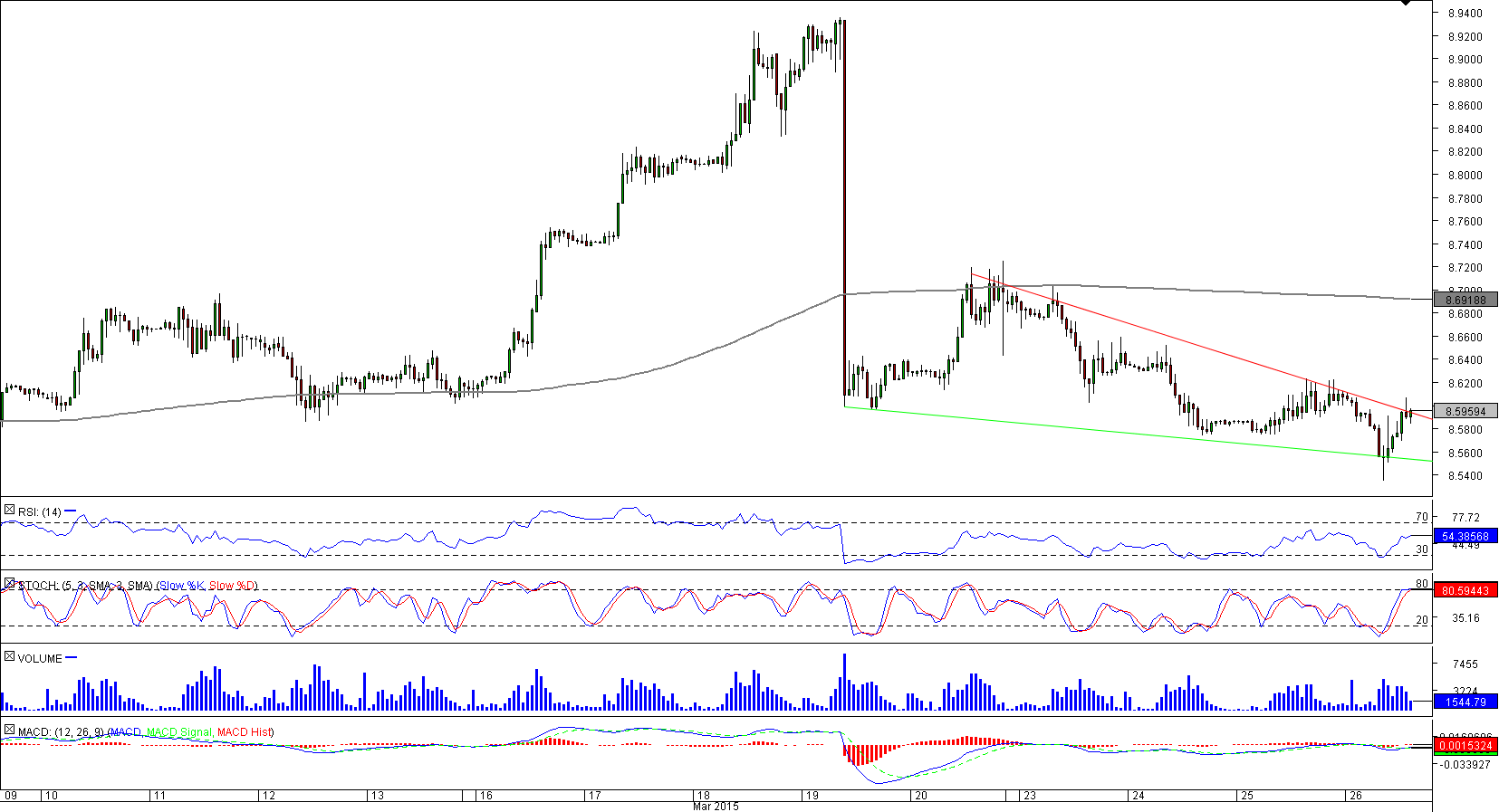

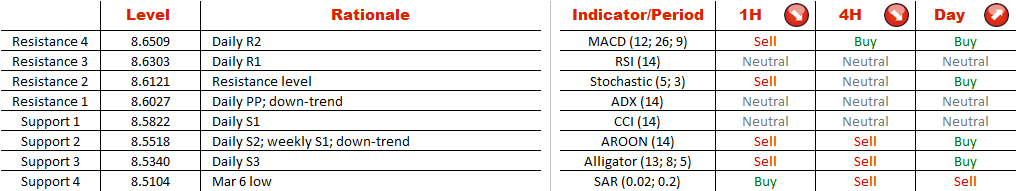

Following exorbitant levels of volatility as a result of the recent FOMC meeting, EUR/NOK seems to be forming a falling wedge. Consequently, we should expect a break-out to the upside. The key level is at 8.6027, reinforced by the daily pivot point. However, the currency pair may also encounter some resistance at 8.6121, but afterwards should be able to reach 8.70, where the 200-hour SMA merges with some of the recent highs.

Following exorbitant levels of volatility as a result of the recent FOMC meeting, EUR/NOK seems to be forming a falling wedge. Consequently, we should expect a break-out to the upside. The key level is at 8.6027, reinforced by the daily pivot point. However, the currency pair may also encounter some resistance at 8.6121, but afterwards should be able to reach 8.70, where the 200-hour SMA merges with some of the recent highs.

In the meantime, the support trend-line is at 8.5518, and it must remain intact. Otherwise, the Euro will be exposed to a drop to the Mar 6 low at 8.5104. Another demand area is supposed to be at 8.48, implied by one of the long-term trend-lines.

Thu, 26 Mar 2015 16:03:07 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

In the meantime, the support trend-line is at 8.5518, and it must remain intact. Otherwise, the Euro will be exposed to a drop to the Mar 6 low at 8.5104. Another demand area is supposed to be at 8.48, implied by one of the long-term trend-lines.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.