Note: This section contains information in English only.

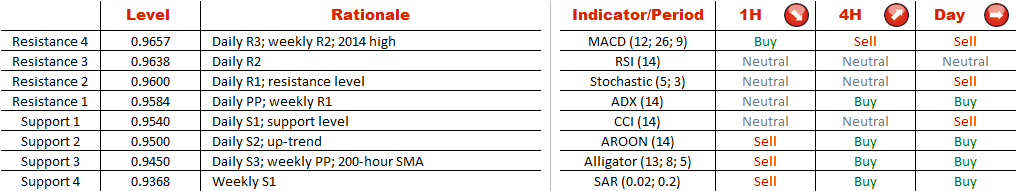

Although the recently discovered ascending triangle has just been broken to the downside, there are still enough reasons to be long the Kiwi. NZD/USD is currently trading between two parallel upward-sloping trend-lines. If the currency pair stays above 0.95, the outlook will remain bullish, though the demand at 0.9540 may also act as a floor. Accordingly, the focus should be on the upside, on the condition that the support trend-line remains intact. One of the key resistance levels is at 0.96, where the daily and weekly R1s merge with the recent highs. Another important supply area is supposed to be near the 2014 high at 0.9657, followed by the resistance trend-line at 0.97.

Although the recently discovered ascending triangle has just been broken to the downside, there are still enough reasons to be long the Kiwi. NZD/USD is currently trading between two parallel upward-sloping trend-lines. If the currency pair stays above 0.95, the outlook will remain bullish, though the demand at 0.9540 may also act as a floor. Accordingly, the focus should be on the upside, on the condition that the support trend-line remains intact. One of the key resistance levels is at 0.96, where the daily and weekly R1s merge with the recent highs. Another important supply area is supposed to be near the 2014 high at 0.9657, followed by the resistance trend-line at 0.97.

Wed, 25 Mar 2015 07:19:03 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.