Note: This section contains information in English only.

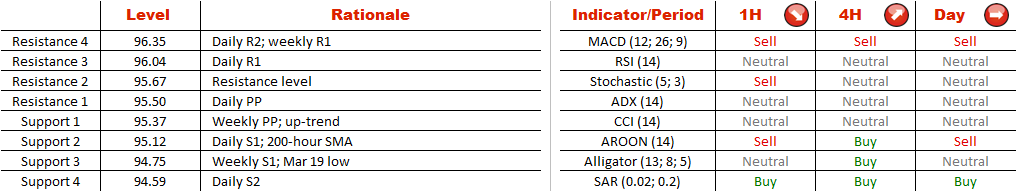

Though the pattern itself favours a bullish outcome, there is a lack of confirmations from the other studies. First, the trend is sideways since the beginning of February. Second, the technical indicators are either mixed or neutral. Still, if the resistance level at 95.67 is broken, the Canadian Dollar is likely to keep appreciating at least until the price reaches 96.83, namely the Mar 5 high. At the same time, violation of the support trend-line and the weekly pivot point at 95.37 will imply a sell-off. However, there are strong demand areas around 95.12 (daily S1 and 200-hour SMA) and 94.75 (weekly S1 and Mar 19 low). In the meantime, the sentiment is bearish: 65% of open positions are short.

Though the pattern itself favours a bullish outcome, there is a lack of confirmations from the other studies. First, the trend is sideways since the beginning of February. Second, the technical indicators are either mixed or neutral. Still, if the resistance level at 95.67 is broken, the Canadian Dollar is likely to keep appreciating at least until the price reaches 96.83, namely the Mar 5 high. At the same time, violation of the support trend-line and the weekly pivot point at 95.37 will imply a sell-off. However, there are strong demand areas around 95.12 (daily S1 and 200-hour SMA) and 94.75 (weekly S1 and Mar 19 low). In the meantime, the sentiment is bearish: 65% of open positions are short.

Mon, 23 Mar 2015 07:42:04 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.