Note: This section contains information in English only.

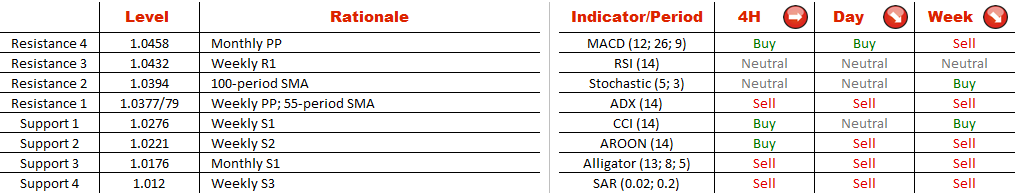

Latest on Friday of this week the AUD/NZD currency pair is estimated to make break-out from the descending triangle pattern, inside which it has been trading since the beginning of November. At the moment there are mixed signs concerning the future development of this cross, but we tend to stay bearish on the Aussie versus the Kiwi. Firstly, technical studies are pointing downwards on both medium and long-term time-frames, suggesting a decline at the end of this week. Moreover, pattern's support is not reinforced by any technical level, and the closest demand area is located only at 1.0276 (weekly S1). SWFX traders, in turn, are holding long opened positions in 74% of all cases.

Latest on Friday of this week the AUD/NZD currency pair is estimated to make break-out from the descending triangle pattern, inside which it has been trading since the beginning of November. At the moment there are mixed signs concerning the future development of this cross, but we tend to stay bearish on the Aussie versus the Kiwi. Firstly, technical studies are pointing downwards on both medium and long-term time-frames, suggesting a decline at the end of this week. Moreover, pattern's support is not reinforced by any technical level, and the closest demand area is located only at 1.0276 (weekly S1). SWFX traders, in turn, are holding long opened positions in 74% of all cases.

Wed, 04 Mar 2015 14:30:06 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.