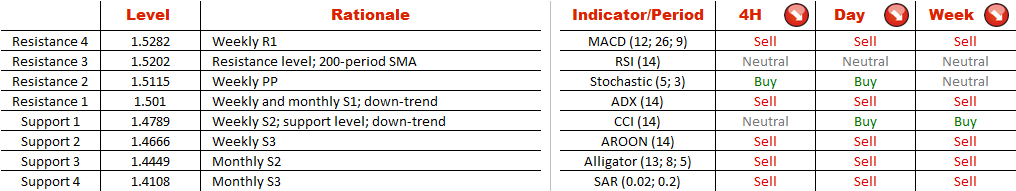

The overall negative bias is also implied by the technical indicators on all three relevant time-frames. On the other hand, the difference between the bulls (46%) and bears (54%) is insignificant.

Note: This section contains information in English only.

As EUR/NZD failed to rally beyond 1.5830 during the first days of February, the currency pair is now headed toward this year's lowest point just beneath 1.48. After a contact with this support the bulls will be expected to push the price back, but the retracement is unlikely to extend further than 1.50, where the multi-week down-trend coincides with the monthly S1 level, creating a potential ceiling. There the Euro will be in a good position to slide under 1.48.

As EUR/NZD failed to rally beyond 1.5830 during the first days of February, the currency pair is now headed toward this year's lowest point just beneath 1.48. After a contact with this support the bulls will be expected to push the price back, but the retracement is unlikely to extend further than 1.50, where the multi-week down-trend coincides with the monthly S1 level, creating a potential ceiling. There the Euro will be in a good position to slide under 1.48.

The overall negative bias is also implied by the technical indicators on all three relevant time-frames. On the other hand, the difference between the bulls (46%) and bears (54%) is insignificant.

Fri, 27 Feb 2015 05:50:30 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

The overall negative bias is also implied by the technical indicators on all three relevant time-frames. On the other hand, the difference between the bulls (46%) and bears (54%) is insignificant.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.