Note: This section contains information in English only.

Wed, 04 Feb 2015 15:13:07 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

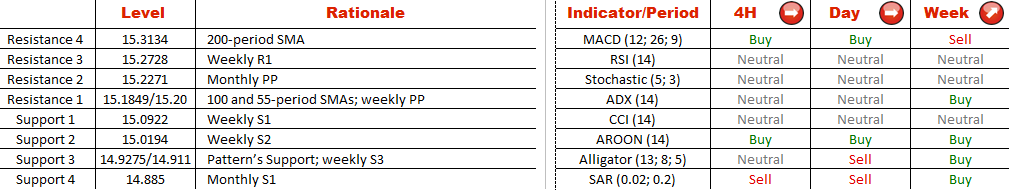

Since November the Hong Kong Dollar has been trading sideways against the Japanese yen. Being that trading range is currently limited between 14.92 and 15.64, the cross managed to form a high-quality and magnitude rectangle pattern on a 4H chart.

At the moment any HKD's attempts to develop beyond the 15.30 mark are capped by the 200-period SMA. Moreover, additional resistance in face of monthly PP is making the bullish case for the future even less attractive. Nevertheless, SWFX market participants believe in pair's ability to advance as 75% of all opened trades are long. Moreover, weekly technical studies also suggest the HKD is going to gain value.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.