Note: This section contains information in English only.

Tue, 03 Feb 2015 13:57:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

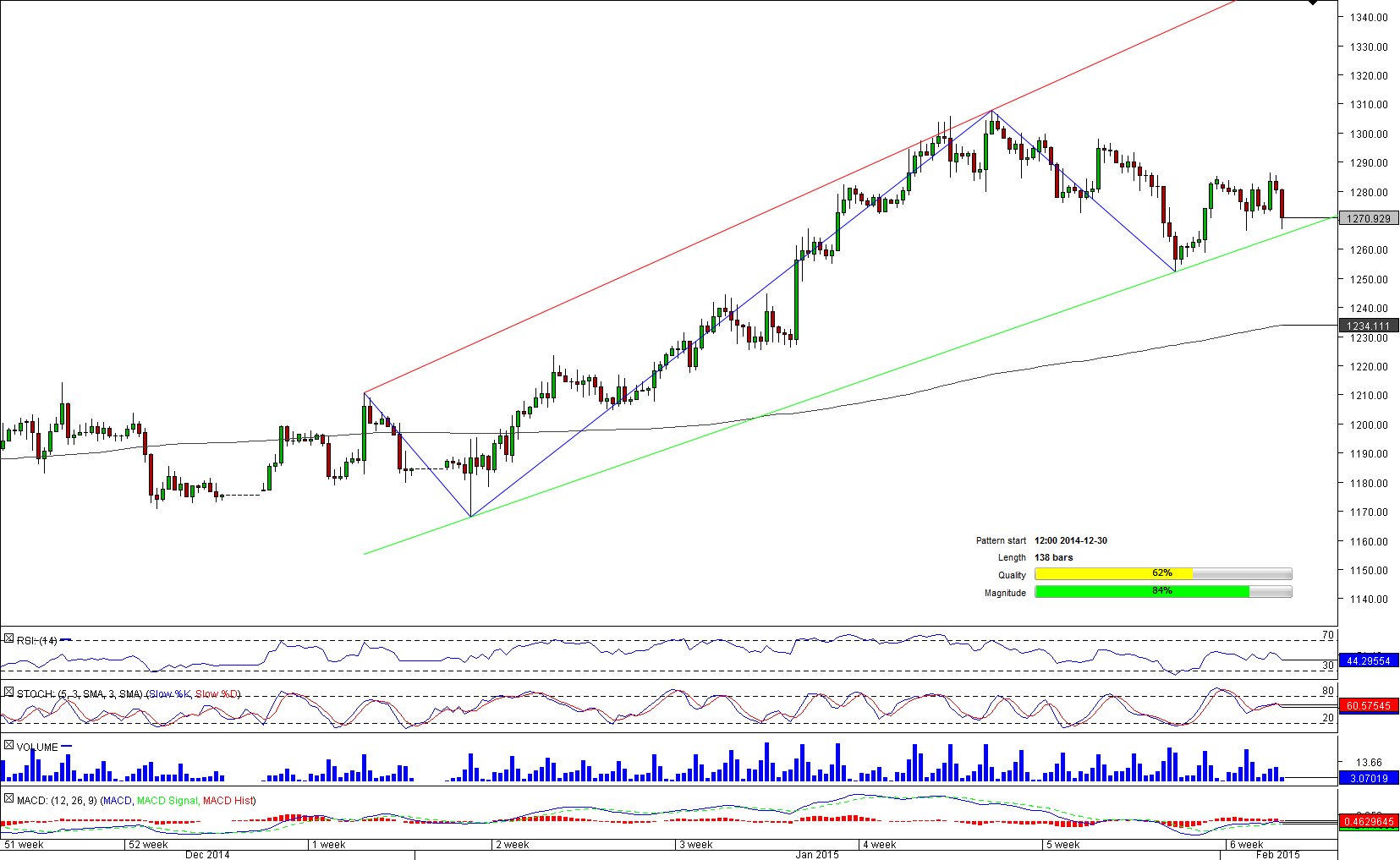

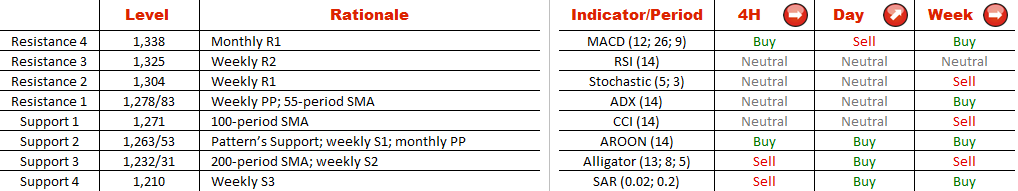

Even though initially Gold has successfully managed to bounce from the lower trend-line of the bullish pattern on January 30, it failed to gain enough positive impetus in order to grow further. XAU/USD is currently limited by a supply area around 1,280 which is represented by the weekly pivot point and 55-period SMA. In case the bullion manages to cross and consolidate above this line, we may observe a rise up to $1,305 (weekly R1) in the near term. This idea is widely shared by SWFX market participants, as they are long on the precious metal in more than 73% of all cases. Moreover, daily technical indicators are giving bullish signals, even despite the fact that the other ones are rather neutral right now.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.