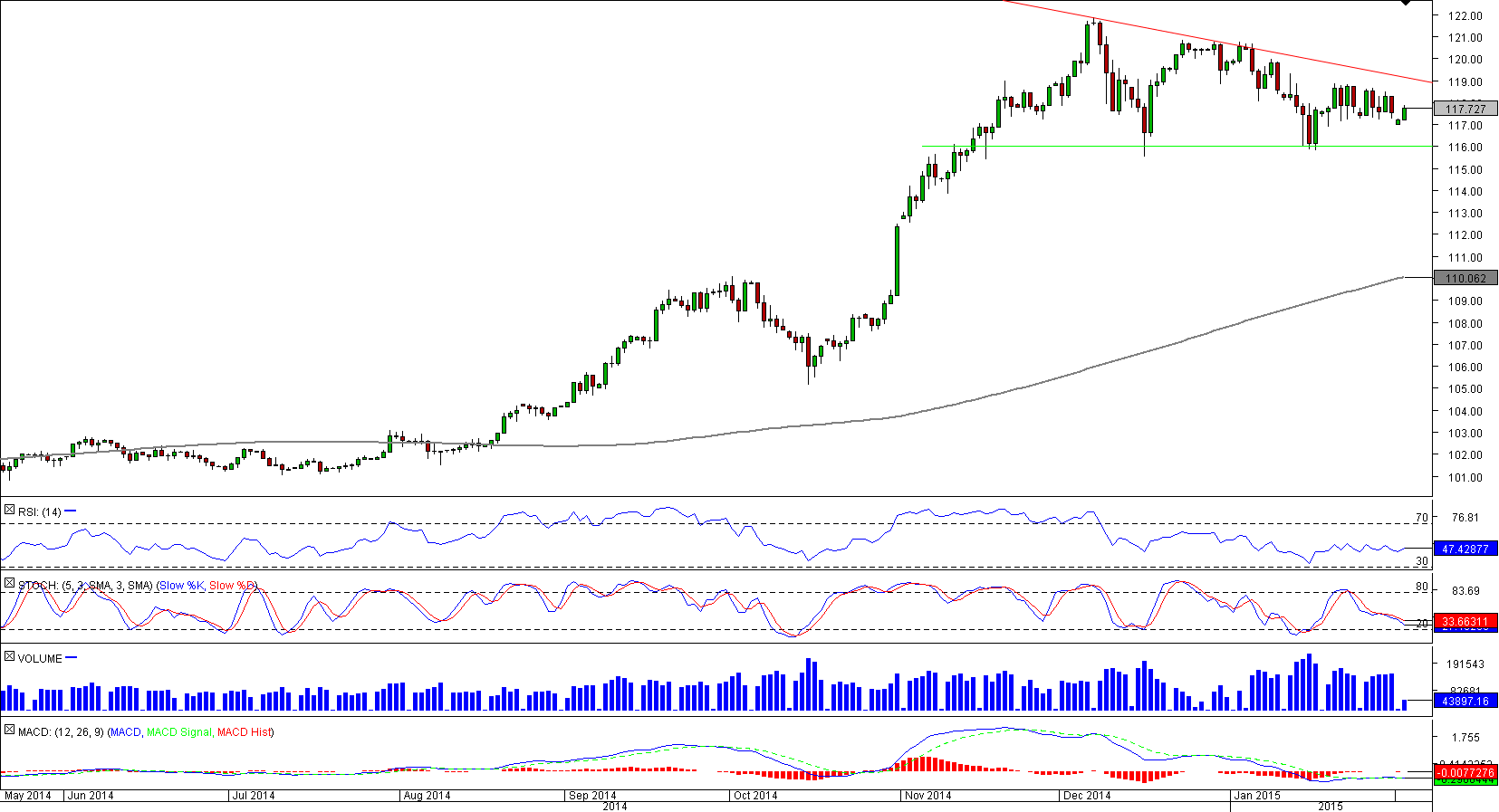

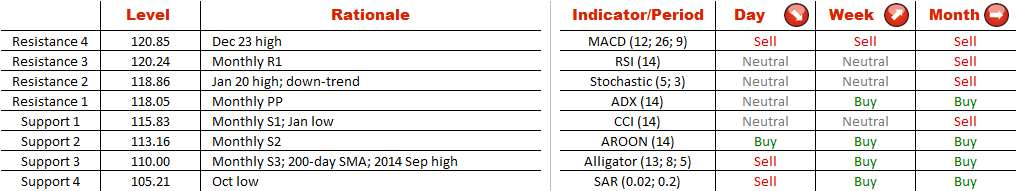

If the support at 116 is violated, the bears will likely push the price six figures south, towards the demand area around 110, created by the monthly S3, 200-day SMA and 2014 Sep high. However, if the down-trend at 119 gives in first, the bulls will have a good opportunity to invalidate the bearish scenario and re-challenge last year's highs (121-122). Meanwhile, the SWFX sentiment is bullish, 59% of open positions are long.

Note: This section contains information in English only.

Judging by the latest developments in USD/JPY, namely emergence of a descending triangle, the demand for the US Dollar is currently weakening. Accordingly, there is an increased chance of a break-out to the downside.

Judging by the latest developments in USD/JPY, namely emergence of a descending triangle, the demand for the US Dollar is currently weakening. Accordingly, there is an increased chance of a break-out to the downside.

If the support at 116 is violated, the bears will likely push the price six figures south, towards the demand area around 110, created by the monthly S3, 200-day SMA and 2014 Sep high. However, if the down-trend at 119 gives in first, the bulls will have a good opportunity to invalidate the bearish scenario and re-challenge last year's highs (121-122). Meanwhile, the SWFX sentiment is bullish, 59% of open positions are long.

Mon, 02 Feb 2015 10:05:05 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

If the support at 116 is violated, the bears will likely push the price six figures south, towards the demand area around 110, created by the monthly S3, 200-day SMA and 2014 Sep high. However, if the down-trend at 119 gives in first, the bulls will have a good opportunity to invalidate the bearish scenario and re-challenge last year's highs (121-122). Meanwhile, the SWFX sentiment is bullish, 59% of open positions are long.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.