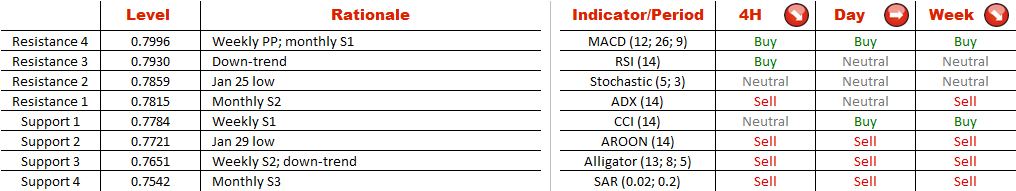

However, in the near term we expect a rally, being that AUD/USD has just encountered the lower boundary of the pattern, meaning there is a good chance the rate will recover up to the upper falling trend-line at 0.79 before targeting 0.7650.

Note: This section contains information in English only.

Following a 20-day upward correction AUD/USD once again finds itself under strong downward pressure. The bears forced the pair to extend the decline from 0.94, where the Aussie traded five months ago. Given that the price has formed a downward-sloping channel and most of the technical indicators point south, the risks are heavily skewed to the down-side.

Following a 20-day upward correction AUD/USD once again finds itself under strong downward pressure. The bears forced the pair to extend the decline from 0.94, where the Aussie traded five months ago. Given that the price has formed a downward-sloping channel and most of the technical indicators point south, the risks are heavily skewed to the down-side.

However, in the near term we expect a rally, being that AUD/USD has just encountered the lower boundary of the pattern, meaning there is a good chance the rate will recover up to the upper falling trend-line at 0.79 before targeting 0.7650.

Fri, 30 Jan 2015 06:58:16 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

However, in the near term we expect a rally, being that AUD/USD has just encountered the lower boundary of the pattern, meaning there is a good chance the rate will recover up to the upper falling trend-line at 0.79 before targeting 0.7650.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.