In the near term the Aussie is likely to negate some of the recent gains. The currency has just reached the upper trend-line of the channel, meaning there should be a bearish correction down to the 0.9850/00 region before we seen another up-swing.

Note: This section contains information in English only.

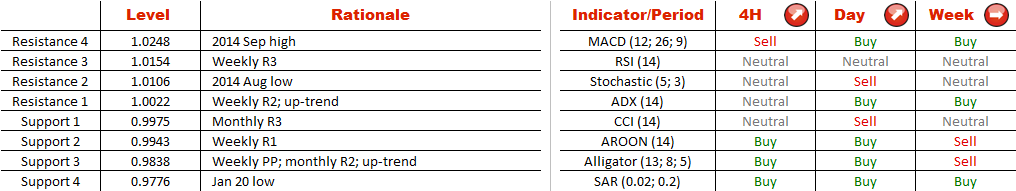

Because of a strong demand area near 0.94 the currency pair was able to commence a recovery late December that still remains topical. Accordingly, the outlook is positive for AUD/CAD, but the bulls should be particularly wary of the resistances at 1.01 and 1.025, represented by the 2014 Aug low and 2014 Sep high, respectively. These levels are potential reversal points.

Because of a strong demand area near 0.94 the currency pair was able to commence a recovery late December that still remains topical. Accordingly, the outlook is positive for AUD/CAD, but the bulls should be particularly wary of the resistances at 1.01 and 1.025, represented by the 2014 Aug low and 2014 Sep high, respectively. These levels are potential reversal points.

In the near term the Aussie is likely to negate some of the recent gains. The currency has just reached the upper trend-line of the channel, meaning there should be a bearish correction down to the 0.9850/00 region before we seen another up-swing.

Thu, 22 Jan 2015 07:14:31 GMT

Source: Dukascopy Bank SA

© Dukascopy Bank SA

In the near term the Aussie is likely to negate some of the recent gains. The currency has just reached the upper trend-line of the channel, meaning there should be a bearish correction down to the 0.9850/00 region before we seen another up-swing.

© Dukascopy Bank SA

Actual Topics

Subscribe to "Fundamental Analysis" feed

Souscrire

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank Binary Options

/ Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Dukascopy Bank CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Crypto Trading / CFD / Forex trading platform, SWFX and other trading related information,

please call us or make callback request.

please call us or make callback request.

To learn more about Business Introducer and other trading related information,

please call us or make callback request.

please call us or make callback request.

For further information regarding potential cooperation,

please call us or make callback request.

please call us or make callback request.